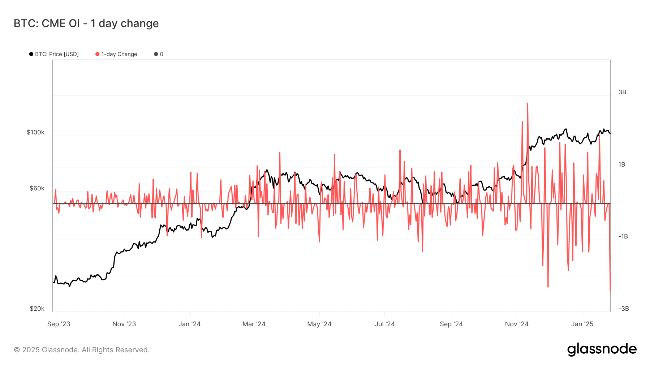

The price of Bitcoin fell, leading to short-term holders exiting the market at a loss and derivative traders also giving up. Glassnode reported that over 21,000 BTC, worth $2.2 billion, was sent to exchanges by short-term holders who had held the coins for less than 155 days. This transfer to exchanges, which often precedes sales, was the second-largest this month, indicating that buyers who purchased when the price was near record highs were spooked by the sudden decline. Other indicators of capitulation, such as negative perpetual funding rates and a drop in open interest on the Chicago Mercantile Exchange, were also observed. Additionally, U.S. listed Bitcoin exchange-traded funds experienced a large outflow of $457.6 million.

Content Editor

( coindesk.com )

Content Editor

( coindesk.com )

- 2025-01-28

Short-Term BTC Holders Quit, CME Open Interest Slid by Record During Monday's Price Drop

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)