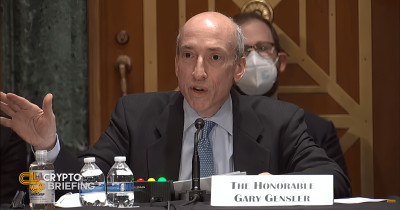

SEC Chair Gary Gensler reiterated the importance of regulatory changes to the definition of "exchange" and alternative trading systems (ATS) in his address at the US Treasury Market Conference. While his focus was on improving the efficiency and resilience of the US Treasury market, his remarks have implications for digital assets. Gensler emphasized the need to update the exchange definition to reflect the rise of algorithmic and high-frequency trading strategies in markets, including those handling digital assets. The SEC's proposal, introduced in 2022, extends registration requirements to platforms acting as market makers for government securities, but concerns have been raised about its potential impact on decentralized finance (DeFi) platforms and digital asset exchanges. Crypto industry participants worry that the broad wording of the proposal could force these platforms to comply with regulations designed for traditional markets. Gensler's push to regulate these platforms has faced opposition from crypto advocates who argue that decentralized platforms are different from centralized exchanges and should be subject to different rules. Platforms like Prometheum and tZero, registered as alternative trading systems, have already obtained special purpose broker-dealer status for digital asset securities and are complying with SEC requirements. The proposed rules are currently under review, and the crypto industry is closely monitoring the potential far-reaching implications for digital assets and decentralized platforms.

Content Editor

( cryptobriefing.com )

Content Editor

( cryptobriefing.com )

- 2024-09-26

Gensler’s exchange rule proposal sparks concerns for DeFi and crypto platforms

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)