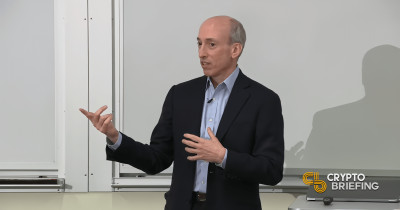

SEC Chair Gary Gensler has suggested that BNY Mellon's crypto custody structure, which was approved for Bitcoin and Ether ETFs, could be applied to other digital assets. The approval is not limited to specific crypto assets and other banks can adopt the same model for crypto custody. The approval is based on BNY's use of individual crypto wallets, ensuring customer assets are protected and segregated from the bank's own assets in the event of insolvency. This guarantees compliance with regulatory requirements and addresses the risk of customer assets being at risk during bankruptcy. The growing crypto custody market presents a lucrative opportunity for financial institutions, with banks well-positioned to offer more secure and regulated solutions compared to non-bank providers.

Content Editor

( cryptobriefing.com )

Content Editor

( cryptobriefing.com )

- 2024-09-26

Gensler suggests BNY Mellon’s crypto custody model could expand beyond Bitcoin and Ether ETFs

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)