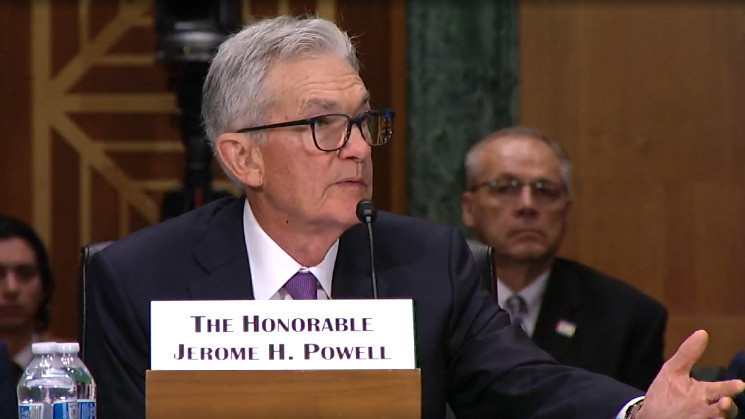

The article highlights that the expected interest rate reduction by the Federal Reserve could benefit Ethereum (ETH) and potentially narrow the yield differential between ether and the Fed. Currently, ether has underperformed compared to bitcoin (BTC) due to the higher interest rates in the US, which have impacted its appeal as a yield-bearing coin. The article suggests that if the interest rate is cut, it could increase demand for ether and lead to a potential rally above $3,000. However, it's noted that the rate cut has already been priced in by interest rate traders, so it may not have a significant impact on macro assets like BTC. Traders should also monitor any signs of Fed hesitation over inflationary policies, as that could affect the pace of rate cuts in the future.

US Department of Justice Issues Statement on Bitfinex Hack That Stole Billions of Dollars of Bitcoin

Jito Labs records $78.9 million in monthly fees for October, doubling its previous record set in May

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)

Content Editor

( coindesk.com )

Content Editor

( coindesk.com )