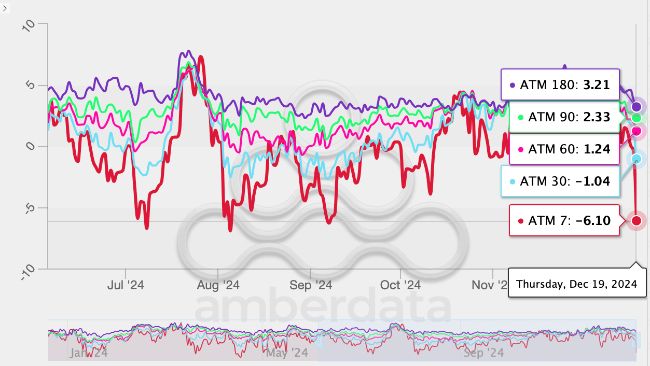

The Federal Reserve's decision to cut interest rates but express uncertainty about future easing has caused concern among crypto traders. This has led to a surge in demand for put options, suggesting traders are hedging against a potential continuation of the recent price slide triggered by the hawkish Fed. The negative sentiment is also reflected in the weaker call bias in options ranging from two to six months. The rate cut decision caused Bitcoin to decline, and Fed Chairman Jerome Powell emphasized caution regarding future moves. Powell also stated that the Fed has no intention of creating a strategic bitcoin reserve. The dot plot projection of future Fed funds rates indicated fewer rate cuts than expected, which resulted in a decline in risk assets. Bitcoin slipped in response and is currently aiming to recover from its losses. The dollar index remains strong, adding to the woes of risk assets.

Content Editor

( coindesk.com )

Content Editor

( coindesk.com )

- 2024-12-19

Hawkish Fed Has Bitcoin Market Showing Strongest Bias for Downside Protection in 3 Months

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)