CandleFocus Is the Crypto Market Bull Run Over or Is Bitcoin Preparing for an Exceptional Bullish Come Back?

2024-12-20

Author: Content Editor

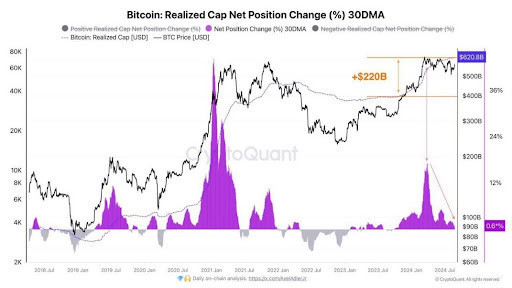

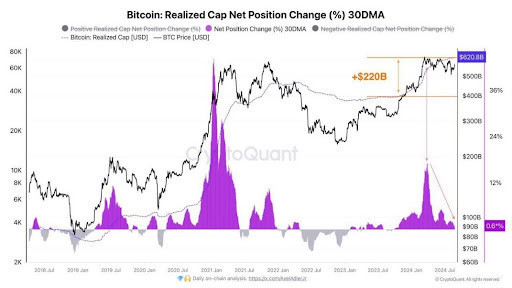

The recent plunge in Bitcoin's price from $108,000 to $96,000 in 48 hours has caused panic-selling in the market. However, analysts argue that this dip is not the end of the bull run but rather a healthy consolidation within an ongoing upward trend. They point out that Bitcoin has experienced a 10% decline after a significant rally, which is seen as a natural correction. Historical patterns suggest that such pullbacks often pave the way for new highs. Key support levels for Bitcoin remain intact, indicating that the bull market structure is still solid. The Federal Reserve's announcements and the U.S. economy's resilience also play a role in market jitters. However, the Fed's gradual approach to rate cuts and slowing of quantitative tightening suggest stability will return in the near future, potentially igniting another crypto rally. Altcoins have been more volatile than Bitcoin during this correction, causing new traders to consider selling or holding while seasoned traders continue to accumulate. In this period of uncertainty, investors are advised to focus on high-conviction projects and avoid leverage. The analyst concludes by saying that patience is key as the market stabilizes, and historical trends suggest that the biggest gains come during uncertain times. The next major move in the crypto market could align with Federal Reserve policy changes, and for now, the bull run is just taking a breather.

Related News

Tether Takes $775M Stake in Video-Sharing Platform Rumble; RUM Shares Soar 41% Scaramucci defends MicroStrategy’s Bitcoin spending, says there is nothing for investors to fear 2025 will be the year of AI agents, Web3 execs say Dogecoin Dives: $29 Million Disappears During Market Collapse —Data Ripple Pledges $5M XRP to Donald Trump's Inauguration Fund Hedera Foundation Appoints Charles Adkins as CEO, What’s Next? How Low Can Dogecoin Go Before It Rebounds? Expert Forecasts Donald Trump's WLFI Buys the Dip with $2.5M Ethereum Cardano Price Faces 45% Downside Risk Amid Open Interest Decline ? Michael Saylor publishes Bitcoin and crypto framework for the US government Solana liquid staking startup Sanctum trials ‘creator coins’ ETH Whale Selling? Ethereum Price Risks $3000 Collapse Polygon Becomes the Third Largest Blockchain Network for Developer Activity in Asia and South America Fantom (FTM) Falls 12% as Whale Wallets Hit Monthly Low Google policy update requires FCA registration for UK crypto ads OpenSea Teases OCEAN Token Launch From New X Account Solana (SOL) Relative Capital Flow Hints Further Growth Ahead: Glassnode US charges developer in LockBit group, paid in crypto Major Company Negotiating Bitcoin Proposal: Report Plume partners with Google Cloud to redefine RWA onboarding ZetaChain Joins Forces with stc Bahrain to Revolutionize Blockchain Interoperability. Charts of the week: HYPE, BGB and MOVE rally in double-digits, Bitcoin crash does not fade gains Top Analyst Explains Why The Crypto Bull Run Is Far From Over 3 New Cryptos Launched This Week to Keep an Eye On Bought Bitcoin at $108,000? Don't Panic ? Bitcoin correction ‘almost done’ as realized losses rise above weekly average Fartcoin hits $1.29 ATH as the broader crypto market bleeds More than 100 crypto hedge funds report banking hurdles in the past 3 years Roaring Kitty’s Cryptic Message Could Spark the GME Ethereum ($GME) Breakout ZNS Connect Partners with Form Network to Revolutionize On-Chain Interactions Luigi Mangione Lands in Same Jail as Diddy, FTX Founder Sam Bankman-Fried Deutsche Bank Teaming Up With This Binance-Listed Altcoin To Build Its Own Blockchain DeFi Protocol Usual's Surge Catapults Hashnote's Tokenized Treasury Over BlackRock's BUIDL Crypto stocks to watch in 2025 Cardano Enters ‘Opportunity Zone’ as MVRV Ratio Signals Potential Bottom Hawk Tuah girl Haliey Welch resurfaces to address her meme coin fiasco, only to get roasted by the internet Chainlink Celebrates 2024 as a Year of Growth, Collaboration, and Innovation CRV and CVX lead DeFi token index sharply higher as market awaits pro-crypto administration EigenLayer restaking protocol's slashing testnet now live Scaramucci Says Some Alts Had Their 'Last Hurrah' Crypto Bull SEC Member Talks About What Will Happen To Cryptocurrencies On Trump’s First Day In Office BTC’s Technical Outlook: Is $96K the New Battleground for Bulls? Horizen spikes 60% to lead gainers as BTC, ETH bounce Bitcoin Under Siege: Bearish Pressure Keeps Price Below $99,575 Powerloom Hits Over 1B New Data Points Prior to Its Mainnet Launch XRP’s Volatility Clamps Down—Traders Prepare for Next Big Move Why is DOGE Down Today? Coinbase Faces Lawsuit over wBTC Delisting: Integrates Apple Pay for Crypto Conversions Ethereum to ramp up gas limit as Pectra progresses The Future Is AI-Centric, and Blockchains Need to Be as Well CoinDesk owner fires 3 editors after Justin Sun article controversy Analyst Justin Bennett Says Ethereum-Based Altcoin Could Explode by Over 600%, Updates Outlook on Solana 2 cryptocurrencies to reach a $5 billion market cap in 2025 Metallicus acquires fintech operator connected to 70 credit unions Famous CEO Announced: "Trump Invests Heavily in These Two Surprise Altcoins Apart from Bitcoin, ETF Approval May Come!" Binance Announces the Listing of Four New Altcoins on Futures: None Listed on Spot Tether CEO teases AI platform launch, targets March 2025 Top Gainers in the Crypto Market: $CKP Leads With a 45.6% Surge Michael Saylor Issues Bitcoin Statement Amid Ongoing Crypto Market Turmoil I don’t support a Strategic Bitcoin Reserve, and neither should you TD Sequential Signals Bullish Momentum for XRP, SOL, MKR, WLD ETH Whale Selling? Ethereum Price Risks $3000 Collapse $164 Million Cardano (ADA) Outflow, Buy Opportunity? Price analysis 12/20: BTC, ETH, XRP, SOL, BNB, DOGE, ADA, AVAX, LINK, TON Filecoin: FIL can rally by 40% only if THIS happens Bitcoin (BTC) Hourly Death Cross Emerges: Details Ether ETFs poised to surge in 2025, analysts say Uniswap (UNI) Price Plummets 20%, Market Cap Shrinks to $7.2 Billion Hedera Hashgraph price rare patterns point to an HBAR rebound Deribit, Bitget CEOs debate how decentralized and centralized exchanges can coexist Quantum BioPharma invests $1M in BTC, cryptos for treasury diversification 5 Privacy Coins Face Delisting on Gate.io Exchange Ethereum ETFs surge in December as inflows hit $1.66 billion, dominated by BlackRock's ETHA Agents of Evolution: Crypto’s Next Act Hyperliquid’s HYPE token surges past $10 billion market cap LayerZero’s Stargate down for 6 hours due to DVN executors malfunction Shiba Inu (SHIB) Bears Gain Ground Over Bulls Amid 22% Price Decline What if Trump and Elon make Bitcoin and Dogecoin legal tender in America? Transak lists 11 meme coins for direct access as one of the biggest Web3 payment providers XRP Rebounds to $2 With 4% Hourly Surge: Details How Aggregation and Decentralized AI Will Completely Reshape Blockchains in 2025 Haliey Welch has ‘woken up’ weeks after Hawk Tuah crypto crash Bitcoin Comeback? Ex-Binance CEO CZ Teases New All-Time High DOGE Founder Reacts to Bitcoin, Dogecoin and Ethereum Sell-off Pudgy Penguins (PENGU) Price Hits Fresh Lows After Losing 10% in a Day Blockchain broadens music royalty access on Audius with ICE deal XRP Lawsuit: US Appeals Court Announces Schedule for Ripple Case Hester Peirce Teases Pro-Crypto Changes To Expect Under New SEC Mystery 666 BTC Transfer Leads to Half Billion Bitcoin Puzzle Why is Bitcoin Crashing? How Low Could the Price Go? 2024 in review: The UAE crypto legal chronicles Bitcoin dips to $92K in ‘optimal dip-buying’ move as PCE boosts crypto Bitcoin (BTC) Price Prediction for December 20 Coinbase and MicroStrategy Plunge 5% Amid Crypto Carnage Top Reasons Why Ethereum Price is Down Today? Babydoge Bridge Smashes $1,000,000 Record in Trading Volume Amid Daily Users Surge Why a Bitcoin Drop to Around $70K is Possible According to Peter Brandt Trading Veteran Peter Brandt Warns Cardano (ADA) Community of 'Potential CAR-crash' Market Expert Says XRP Fears Are All Noise, Provides Price Update Amid Downtrend Expert Trader Predicts When Bitcoin (BTC) Bulls 'Will Try to Make a Stand' How a Journalist Went From Exposing Mexican Cartels to Losing His Crypto Life Savings Bitcoin Hits $92K Amid Sell-Off: Could a 30% Crash Be in the Cards? Tornado Cash co-founder Roman Storm wants charges dismissed – OFAC ‘overstepped’ TON Foundation and GMX Join Forces to Advance High-Performance DeFi Dogecoin (DOGE) Drops 20% in 24 Hours, Risks Further Declines Dogecoin (DOGE) Loses 40% From Top: What's Next? 2.75 Trillion SHIB in Hours, What's Going On? Solana Price Prediction: Will SOL Hit $400 or Face Further Correction? It’s Time to Admit It – There Are Only 2.1 Quadrillion Bitcoins 10 Million RLUSD Moved in One Hour as Things With Stablecoin Heating Up Russia’s bank governor confirms no plans to invest in cryptocurrencies Bedrock Unveils brBTC, Pioneering BTCFi 2.0 Ripple Price Analysis: XRP Could Slump to $1.4 if This Support Level Doesn’t Hold Dogecoin price is in a bear market: how low can DOGE fall? Bitcoin Price Prediction Today: Bears Target $82,500 After Market Bloodbath Why These Altcoins Are Trending Today — December 20 Bitcoin price has nosedived: 4 reasons it will recover and hit ATH MoonPay Secures Money Transmitter License in Texas, Expanding Crypto Access for Millions Binance Alpha adds LUCE, BANANA and others to fourth batch of selected tokens Jim Cramer Issues Advice to Investors Amid Bitcoin Slump to $94,000 and Stock Market Collapse What analysts say about the market next year BrokenBound and IntoVerse Unite to Smooth Crypto Payments US uses first-of-its-kind email seizure to disrupt $5M crypto scam Exploring Five On-Chain Indicators to Understand the Bitcoin Market Cycle EU’s MiCA Regulations Push Tether’s USDT Off Major Crypto Exchanges ? Bitcoin Tumble Triggered $1.4 Billion in Liquidations Singapore, Hong Kong Lead the Blockchain Revolution, Not US Here are XRP key support and resistance levels to watch this weekend 21Shares Registers Polkadot Trust in Delaware NFT Doodles Collection Hints at Potential Token Launch Here's Why XRP Is Stronger Than You Think: Price Details Litecoin: 78% of LTC Holders Refuse to Sell, Here's Likely Reason Fading Altcoin Dominance Threatens XRP Price as DEX Volume Shrinks By $58 Million Ethereum Price Crash amid ETF Developments – What’s Happening? Mantle Becomes World’s Biggest ZK Rollup in Partnership with Succinct Labs XRP Price Prediction for December 20 Will Bitcoin crash below $90k? Blum Memepad Receives $500,000 Grant from TON Memelandia and Partners with Major CEXs Debate over Ethereum gas limit: Lower fees vs. Network stability Giant Company Announces It Will Convert Some of Its Treasury Assets into These Three Cryptocurrencies Bitcoin Plunges to $93K, Dogecoin Down 27% as Crypto Bloodbath Goes On VeChain Simplifies Web3 with Social Login Wallet Management On-Data Confirms XRP Historic Rally Dragged Down Bitcoin Dominance Bitcoin Drops to $92,118 as Crypto Economy Shrinks by Nearly 12% Bithumb faces temporary XRP withdrawal delays as volume increases Zero1 Labs Connects with The Ignition AI Accelerator to Empower AI Startups Globally Solana whale sbfonchain.sol is back to buying the hottest meme tokens Coinbase Revenue Outpaces Nasdaq—Here's What Analysts Say It Means CoinGecko Analyst Discusses Top Performing Crypto Narratives of 2024 Collably Network Joins Forces with COPX to Transform Web3 Financial Ecosystems Messari Founder Kicks XRP Amid Price Decline PENGU Token Drops 25% After Airdrop Frenzy : What’s Next for Pudgy Penguins? XRP crashes below $2, erasing $24 billion in a day Ripple’s XRP Ledger Leads Institutional RWA Tokenization With New Partnerships Long-Term Bitcoin Holders Have Sold 1M BTC Since September: Van Straten Bitcoin Demand Hits 3-Year High; Signs of 2015-2018 Bull Run Reappear Cardano Price Breaks Below 50-Day EMA: Downside Risk Targets $0.70 Daily Market Review: BTC, ETH, ENA, AIOZ, FTM DeBridge (DBR) Price Hits ATH After 30% Jump on Major Listing 70% of Jasmy Holders ‘In the Money'—Will' Bulls Take Over? From $4.4 Million Profit to $3.7 Million Loss: Greedy Investor in Trouble with Bitcoin (BTC) Trading! Here's Why! SEC Approves Bitcoin-Ethereum ETFs, but Prices Continue to Fall Bitcoin “Buying the Dip” Mentions Surge to 8-Month High as Price Drops to $95K Base Outpaces Ethereum in User Growth as Crypto Market Evolves, New Report Reveals Timelines for Dogecoin to Hit $10, $20, $50 and $100 Binance Founder Changpeng Zhao Lauds Major Listing, BNB Price To Hit $800? Cardano’s Hoskinson Believes the Path for US’ Crypto Dominance Lies in Fostering Solid Regulation Ethereum Price Dips Below $3,400: Will $3,035 Support Hold? Will Ethereum Whale Selloff Trigger ETH Price Crash Under $2,800? Samson Mow on Bitcoin Crash: 'Supply Shock Is Coming' IOTA Rebased: Staking Rewards with 10-15% APY, 50,000+ TPS, and 500 ms Finality Highlight Network Success Here’s why MOVE rallied 26% as the crypto market tanked Barclays-backed Copper withdraws UK crypto license application $12 billion wiped from Solana (SOL) in a day Analyst Says Altcoin That’s Rallied Over 21,000% Year-to-Date at a ‘Do-or-Die’ Level, Updates Outlook on Bitcoin Is Virtual's Price Decline a Buying Opportunity? Bitcoin User Pays an Outrageous Fee of 8.18 BTC Worth $808,564 for a Single 0.14 BTC Transaction Orbs Unveils Liquidity Hub V2 to Redefine DEX Liquidity "Brokers Must Differentiate Between Trade Platforms and Trade Engines”: Your Bourse’s CRO This Week in Meme Coins: Fartcoin Surpasses $1 Billion, PENGU Simmers While Dogecoin Disappoints BONK goes live on Robinhood as meme coins continue to struggle Europe fumbles crypto playbook as Trump’s America leaves it behind Shiba Inu Lead Promises to Silence SHIB Haters Soon DuckChain announces strategic partnerships and secures $5M in financing Dogecoin Price Plummets 25%, Will DOGE Drop Below $0.2 Soon? Santiment: "Whales Bought These 10 Altcoins While Bitcoin (BTC) Was Falling!" ‘X-Mas Rally Is Still On’: Economist Henrik Zeberg Says Bitcoin Set To Hit New Record High – But There’s a Catch Is the Crypto Market Bull Run Over or Is Bitcoin Preparing for an Exceptional Bullish Come Back? DWF Labs Acquires 100B $MONKY After Binance Alpha Listing Ethereum layer 2s hold $13.5B stablecoin supply Analyst Projects XRP Rally to $251 Following 5.5-Year Consolidation Phase Breakout L2BEAT announces framework changes: L2s will face tougher rules in 2025 Mind Network Launches World AI Health Hub with InfStones and ZAMA South Korea's Second Largest Cryptocurrency Exchange Bithumb Listed a New Altcoin! Here Are the Details Unstoppable Domains and a community on Reddit for the .DONUT domain Solana Traders Hold Out for Fast Turnaround After SOL Price Breaks Below $200 Ethereum price drop forces whales to sell ETH in millions to repay debts Bankrupt Cryptopia exchange distributes $225M to hack victims Dogecoin Founder Says ‘WAGMI’ as Bitcoin, DOGE Prices Crash Shiba Inu to $0.01 Closer to Reality? Why a Key Chainlink Partnership is Stirring Hopes Ark Investment CEO Cathie Wood predicts Bitcoin to hit $1M by 2030 Bitcoin Dips and Kiyosaki’s Buying Message Gains Traction Injective and Sonic SVM Partners to Launch the First Cross-Chain AI Agent Platform Binance Futures Changed This Altcoin's Delist Date! Here Are the Details OKX unveils Ordinals Launchpad platform for direct Bitcoin inscription XRP Price Dips To $2.2, Here’s The Key Support Level To Watch Cardano Drops Below $1: Opportunity Zone Revisited After 4 Months Mapping APT’s road to $19.47 – Here’s what MUST happen! Trump Crypto Project Buys 722 Ethereum Worth $2.5M Amid Dip Cardano Price Crash – Will ADA Drop Below $0.50? Is Pepe Coin Price Heading Below $0.00001? Whale Sell-off Sparks Fear Here is How High XRP Can Surge if SBI Allocates 20% of Assets to XRP Reserve Over $2.6 Billion Options Expiring Today: What It Means for Bitcoin and Ethereum Stablecoins are the “killer use case” for crypto, says experts amid MoonPay and RLUSD partnership BG Labs Partners with IOST to Revolutionize Web3 Gaming and DApps GalaChain Pioneers BFT on Hyperledger, Paving the Way for Next-Level Decentralization XRP Price: 5 Key Reasons To Not Sell XRP Tokens Ordeez is Reshaping the NFT Landscape with Ordinal Derivatives Crypto chatter about ‘buying the dip’ hits 8-month high: Santiment US Bitcoin ETFs see historic outflows as brutal sell-off shakes crypto markets Firm building decentralized supercomputer attracts 1.5M nodes during testnet AAVE worth $3.2M bought in one day: Is $500 within reach in 2025? Altcoins Shine as Bitcoin’s Market Dominance Wanes New El Salvador Bitcoin Purchase Boosted With 11 BTC Bitcoin's trajectory shows similarities with previous cycles as long-term holders book profits of $2.1 billion DOGE and USUAL Partnership False, Vivek Ramaswamy Account Hacked Why Ripple’s SEC Lawsuit Might Be a Strategic Masterstroke Morocco to Adopt a Legal Framework for Crypto Assets Polygon AggLayer Testnet Launched: Is POL Heading to $1? As Bitcoin's Post-Fed Price Dip Extends, This Key Contrary Indicator Offers Fresh Hope: Godbole Bitcoin Technical Analysis: Intraday Support at $98K Tested as $104K Resistance Looms Secret Network Launches Claive AI With Privacy at Its Core This Man Sold His House for Bitcoin in 2017—Now He Can Buy 25 Homes Solana (SOL) Price Prediction For December 20 SEC Approves Nasdaq, Cboe BZX Rule for Crypto Index ETFs XRP Challenges BTC and ETH: Key Metrics Highlight the Battle for Market Capital Chainlink Price Pullback: Why Analysts Aren’t Backing Down on $35 Prediction Ethereum (ETH) Price Prediction For December 20 Indonesia concludes proof of concept for wholesale CBDC XRP Price Prediction For December 20 Crypto Prices Today December 20: BTC at $97K, MOVE Gains 30%, ZEREBRO Rises 56% XRP Price Shows Resilience While BTC Sinks Deeper Arbitrum Whales Bought 40 Million ARB Tokens over the Past One Week: Crypto Trader Ali Martinez XRP Lawsuit To End Soon? SEC Prepares For ‘Potential’ Shutdown XRP Price Readies For Record-Breaking Peaks As Bollinger Bands Signal 490% Upswing Ethereum Price Takes a Plunge: Can Bulls Step In? Tornado Cash dev wants charges dropped after court said OFAC ‘overstepped’ Dogecoin Trading Volume Rises Over $6.5 Billion As Liquidations Cross $31 Million, What’s Going On? XRP Price Prediction for December 20, Will the $2.2 Mark Hold? HK fast-tracks digital assets licensing; S. Korea delays regulation El Salvador: World's First Country to Have a Bitcoin Reserve Bitcoin Decline Continues: Are Bulls Losing Control? Flamingo opens testing for Orderbook+ 2.0 on Neo N3 TestNet The Human Rights Foundation (HRF) distributes 7 BTC across 20 projects worldwide Dogecoin, Meme Coins Fall as Fed Fears Linger Ethereum To ‘Teleport Moonward’ Once ETH Breaks Above All-Time High, Says Guy Turner – Here Are His Targets Young People Embrace Cryptocurrency More Actively PoP Planet Joins Forces with DeTrip, Redefining Travel with Crypto Payments Crypto Market Tumbles as $588M Liquidations Spark Panic Bitcoin’s Exchange Transactions Hit Record Lows—What This Means For BTC’s Price This Analyst Predicted The Dogecoin Price Crash 2 Days Ago, Full Prediction Shows A Further 30% Decline Rise of MicroStrategy clones, Asia dominates crypto adoption: Asia Express 2024 review Bitcoin Price Crash: Will BTC Sell Off Continue Ahead? TokenPocket Unveils Mastercard Crypto-to-Fiat Debit Card for Asian Users A Crypto Whale Strikes Gold, $6M in Profit By Trading $SHIB in Couple of Hours John Deaton Calls Out Elizabeth Warren Crypto Stance and Bank Lobbying Ties SEC approves Hashdex and Franklin Templeton dual Bitcoin-Ethereum ETFs Bitcoin’s Path to $350K by 2025? Trump’s Endorsement and Market Trends Fuel Optimism Crypto crash triggers $1 billion in leveraged liquidations over past 24 hours Shiba Inu (SHIB) Lost Major Support, XRP Bullish Formation Invalidated, Dogecoin (DOGE) Reaches Key Support Level BlackRock Has a New Bitcoin Video Ad—And Bitcoiners Hate It SEC prepares for potential government shutdown amid congressional impasse Crypto Market Drops 10% as Over $1 Billion Liaquidated Since Fed’s Rate Cuts Crypto Liquidations Reach $1.1B, Bitcoin, Ether, XRP Crash! Bitcoin Crashes: Here’s Where The Nearest On-Chain Support Is