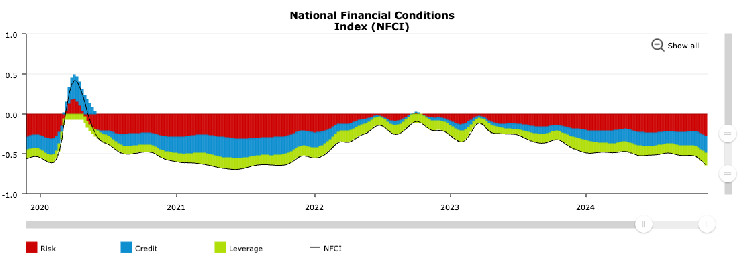

The financial conditions in the U.S. are the loosest they have been in three years, as indicated by the Chicago Fed's National Conditions Index (NFCI). This index takes into account factors such as leverage, debt, equity markets, and traditional banking. The negative reading of -0.64 suggests that financial conditions are looser than average, indicating readily available liquidity. These loose financial conditions have contributed to an increase in risk-taking and investor appetite for assets such as stocks and cryptocurrencies. Despite U.S. headline inflation being well above the Federal Reserve's target, interest rate cuts have done little to rein in investors' risk appetite. The rally in Bitcoin is particularly interesting as it breaks the typical inverse correlation with the U.S. dollar, highlighting its ability to thrive in loose financial conditions.

Content Editor

( coindesk.com )

Content Editor

( coindesk.com )

- 2024-12-04

With U.S. Financial Conditions the Loosest in Years, Bitcoin Can Continue to Thrive: Van Straten

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)