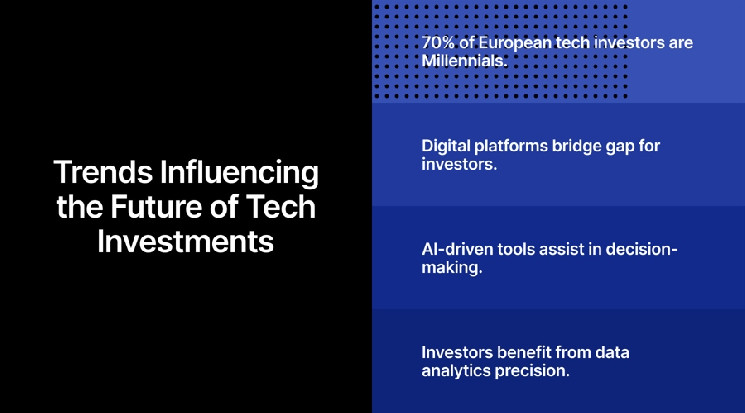

The investment ecosystem is changing, with digital platforms and a generational shift among investors driving increased accessibility. Research shows that a majority of European accredited tech investors belong to Generation X and Millennials and are exploring online co-investment platforms. This marks a significant moment for the democratization of late-stage private investments. Digital platforms are bridging the gap for investors to access high-growth companies traditionally reserved for large funds. However, there are challenges in terms of diligence and transparency. Platforms are addressing these challenges by employing sophisticated vetting processes and AI-driven tools. Investors can now evaluate opportunities in high-tech sectors with rapid innovation cycles and complex risk profiles. The integration of digital platforms has revolutionized efficiency, allowing investors to review metrics, evaluate terms, and execute investments from their devices. AI and data analytics help identify market trends and assess risks accurately. The evolution of high-tech investments is redefining who can participate and how value is created. Platforms play a pivotal role in shaping the future of private investments by aligning with lead investors, embracing technology, and fostering transparent ecosystems.

Analytics Company Researcher Says “I’m Not Buying Right Now” Despite Bitcoin’s Decline, Explains Why

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)

Content Editor

( financemagnates.com )

Content Editor

( financemagnates.com )