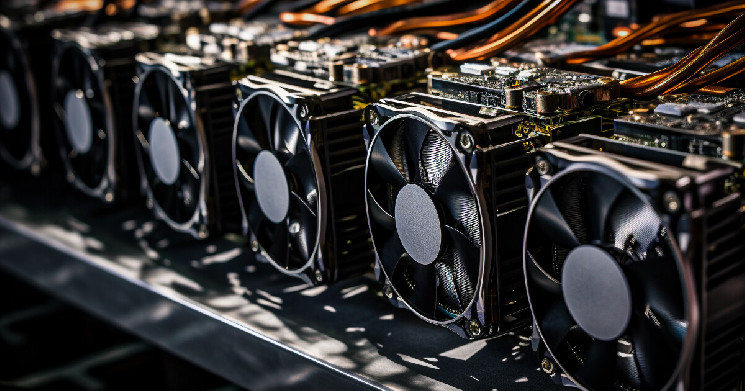

A recent report from Clear Street indicates that Bitcoin miners are exploring yield strategies for their BTC holdings and diversifying into AI compute. The report outlines three key themes for 2025: generating revenue from Bitcoin reserves, leveraging existing infrastructure for high-performance computing (HPC), and benefiting from a shift in US regulatory leadership. Miners are looking into creating income from stored BTC through securities lending once regulatory adjustments are made. The report suggests that a new SEC stance could allow miners to exchange bitcoin for ETF units and earn income through share lending. Miners such as CleanSpark, Bit Digital, Bitfarms, and TeraWulf are mentioned with various holding or approach strategies. In addition, miners are repurposing their data centers, power sources, and equipment for AI-driven workloads, aiming to diversify earnings beyond mining. The report also states that political shifts, such as potential changes at the SEC and Department of Energy, could be beneficial for the industry. However, uncertainties could arise from cuts in federal spending or energy policy changes. Clear Street identifies Bit Digital, CleanSpark, TeraWulf, and Bitfarms as top picks based on valuations, expansion potential, and HPC roadmaps. The projections for increased revenue for miners rely on their ability to scale data center operations, secure power agreements, and navigate regulatory steps.

Content Editor

( cryptoslate.com )

Content Editor

( cryptoslate.com )

- 2025-01-06

Bitcoin miners to soar in 2025 amid AI hosting and BTC yield strategies - Clear Street

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)