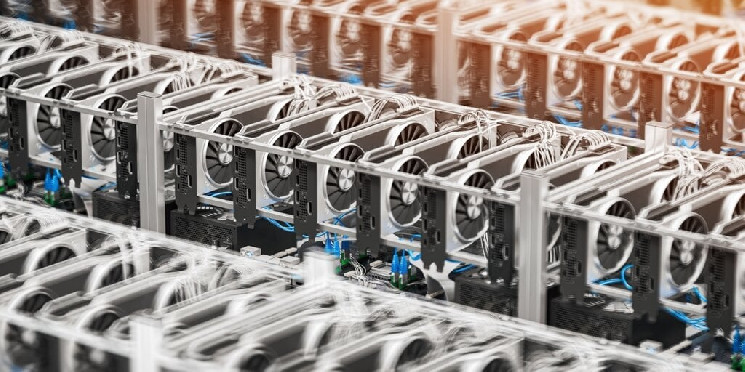

Publicly traded Bitcoin miners have lost a collective $23 billion in market capitalization in the past month, according to a JP Morgan report. Stock analysts are closely watching data center deals, energy costs, and efficiency improvements in mining operations. Hut 8, for example, reported a 69% increase in revenue for 2024 and is said to be close to signing a major HPC/AI deal with a hyperscaler. The company also managed to reduce energy costs by 30% and increase gross margin per Bitcoin mined. Despite expectations of rising mining costs in 2025, analysts believe the appreciation of BTC price will benefit miners. It's also important for investors to consider factors like diversification of revenue streams and ASIC chip development in mining companies. Core Scientific, for instance, is working on designing its own ASIC chips in collaboration with Block Inc. CoinShares is keeping an eye on Bitdeer, which is gaining market share through its SEALminer A2 rigs.

Content Editor

( decrypt.co )

Content Editor

( decrypt.co )

- 2025-03-08

How Analysts Are Rating Bitcoin Miners’ Pivot to AI and Chip Manufacturing

Esponel (es)

Esponel (es) Türkçe (tr)

Türkçe (tr) Russian (ru)

Russian (ru) 한국인 (kr)

한국인 (kr) Italiano (it)

Italiano (it) हिंदी (in)

हिंदी (in) عربي (ar)

عربي (ar) Français (fr)

Français (fr) Deutsch (de)

Deutsch (de) 日本 (jp)

日本 (jp) 中国人 (cn)

中国人 (cn)