CandleFocus Bitcoin's $5.8B Quarterly Options Expiry May Spark Market Swings, Deribit Says

2024-09-25

Author: Content Editor

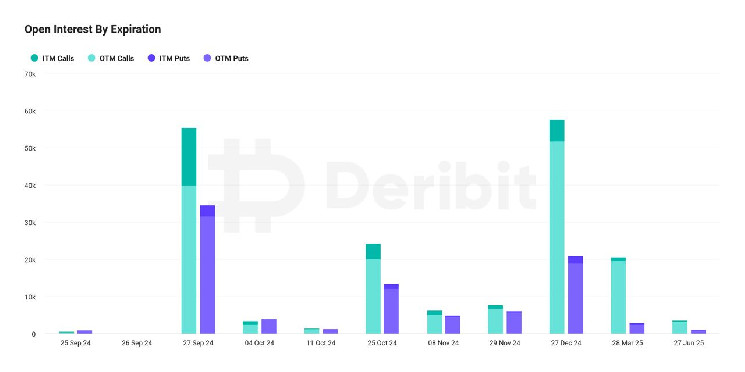

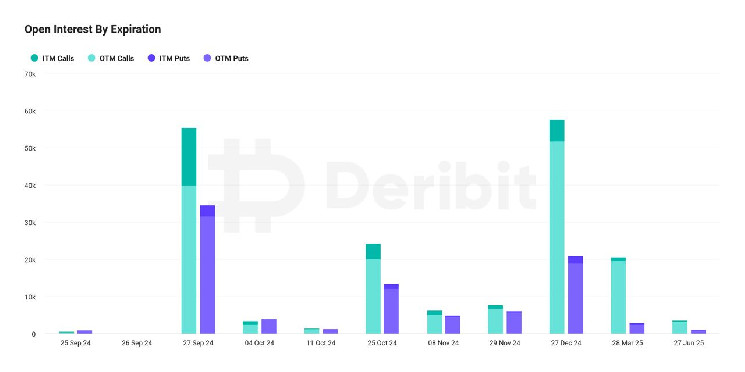

On Friday, a significant amount of bitcoin and ether options contracts are set to expire, potentially leading to price swings in the market. The expiration of these options contracts, worth several billion dollars, could result in heightened market volatility as traders close or roll over their positions. About 20% of bitcoin options contracts are "in-the-money," meaning they have favorable strike prices compared to the current market rate. This could impact prices as holders exercise their right to buy or sell profitably. Looking ahead, the approval of options tied to BlackRock's bitcoin ETF could further accelerate institutional adoption and drive activity in the market. The current max pain level for bitcoin's expiry on Friday is $59,000, which could create downward pressure on prices as it is below the spot price. However, the overall outlook in the options market remains bullish, with calls being relatively more expensive than puts, indicating a positive sentiment for bitcoin and ether.

Related News

Bitcoin Capped Below $65,000 As RSI Falls Below 80 In Monthly Chart: Should You Worry? COMP price surges 17% in a week, confidence restored after Compound Discord breach Solana Meme Coins Explode, Time to Buy SOL? 5 DePin Coins to Add to Your Portfolio in October 2024 Bybit Reaches 50 Million Users, Expands Global Compliance and Web3 Integration With 252,200 BTC, Is MicroStrategy Preparing for Bitcoin’s Next Big Move? Uniswap L2 activity in September tripled compared to last year Bittensor (TAO) Eyes $700 as Bullish Indicators Hold Strong OpenAI CTO Mira Murati exits after pivotal role in AI development Analytics Company Reveals the Best and Worst Altcoins Distributed in Airdrops Crypto needs ‘to work closely with the regulators:’ Gemini deputy general counsel Solana surpasses Ethereum in 24-hour Dex volume on DefiLlama Solana (SOL) Consolidates in Symmetrical Triangle – Analyst Reveals $160 Target On Breakout Curve mulls dropping TUSD as crvUSD backing after SEC charges Arris Partners with AlterVerse to Elevate AI-Powered Gaming Will Bitcoin Be "Big Winner" This Year? Scaramucci and Pompliano Think So BItMEX Founder Arthur Hayes Says Next Presidential Administration Irrelevant for Crypto – Here’s Why Bitcoin (BTC) Bullish Setup Awaiting Confirmation, Says Veteran Trader John Bollinger Render price recovers amid whale accumulation DRiP CEO: Crypto’s transparency and speed diminish any speculation Top $BONK Whale with 2.41 Trillion Tokens Also Holds $566K in $TAI, Data Shows On-chain metrics signal a bullish outlook for Floki amid Valhalla’s partnership with Alliance Top 3 Reasons Why Bitcoin Is Poised To Rise In An 'Uptober' Rally Worldcoin launches in three more countries; WLD token spikes Republicans introduce bill forcing Gary Gensler to testify biannually Ethereum (ETH) Burn Rate Spikes 168%, What's Happening? Ledger Live Now Supports Ripple USD (RLUSD) Before Launch A US Court Ruled in Favor of the SEC in a Cryptocurrency Case! Hamster Kombat launches listing, but community is still unhappy Asphere Partners with Babylon to Pioneer Innovative Bitcoin Layer 2 Solutions TapSwap airdrop appears delayed, mirroring Pi Network Hoppy meme coin hits 2-month high as holders jump Bitcoin ETFs May Soon Surpass Satoshi Nakamoto Upcoming Telegram Aidrops Could Help Toncoin (TON) Price Reclaim $7 Legendary Trader Peter Brandt Breaks Silence on Bitcoin Price Bull Flag Pattern Solana memecoin $MOTHER reclaims $100M market cap SUI Eyes $1.45 Retest Following Breakout: Will Bulls Defend Support? Ethereum Funding Rate Surge Signals ETH Price Rally to $3,000 Fox Wallet Partners with Tonshi to Enhance Gaming Experience on TON Blockchain Resolution Urging Nigeria to 'Immediately Release' Jailed Binance Exec Heads to US House Sui Price Gears Up for $2 Breakout as TVL Edges Closer to $1 Billion Starknet announces first phase of staking AI-Focused Cryptos Outshine the Pack This Week, Bittensor Tops Gains Anthony Pompliano on Why Liquidity Will Drive Bitcoin to New Heights Bitcoin’s Volatility Is Its Strategic Edge Crypto trader turns $1.3k into $3.4 million in 15 days Will BNB Price Target $800 as Binance Expands with Pre-Market Launch? Macquarie sets 'outperform’ ratings on MARA, Riot and other bitcoin mining stocks amid shift to AI and HPC infrastructure Ripple’s Partners dLocal and ShopeePay Expand to Southeast Asia Ethereum Faces A First Barrier Of $2,700 And Falls Back EA Capital Obtains Crypto Asset Service Provider License in South Africa Dogecoin Price Forecast as DOGE Founder Vows to Never Create Another Crypto Chainlink Price Poised for Breakout, Eyeing 50% Surge: Will Market Sentiment Hold? Su Zhu, Co-Founder of Defunct 3AC, Shows off His Crypto Trading Acumen LUNC News: Terra CEO Chris Amani Confirms Plan If Negotiations Fail The Three Doors: Which One Will Bitcoin Step Through? Analyst Predicts Optimism (OP) To Soar Driven by Superchain Interoperability LayerZero activity surges 433% following second airdrop announcement BREAKING: PayPal Takes Historic Cryptocurrency Step – Will Allow Buying, Selling and Hold Bitcoin price is set to 'crash and produce one major low' Bitcoin price coils as market confirms $65K as ‘real resistance’ a16z begins investing in DeSci with AminoChain, leads $5M seed round Fed’s ‘juice’ into crypto has analyst eyeing ‘trimming’ opportunities UAE's clear regulations have fostered a balanced, diversified crypto ecosystem – Chainalysis Bitcoin Dominance at Risk as Altcoin Market Cap Targets $1.5 Trillion Wallet in Telegram app temporarily blocked for UK users due to restructuring Sell-off Alert! Bitcoin Whales Sold $1.28 Billion of BTC, Price Drop Coming? Triple Top Spotted on BNB, Eyes on 18% Price Decline CHART: Everyone sentenced from FTX and Alameda Solana could hit 50% of Ethereum’s market value, predicts VanEck Retail Accumulation and Exchange Outflows Drive Market Optimism for Bitcoin Ethereum demand concentrated in a few speculative use cases, CoinShares report finds US yield curve and derivatives interest are bullish signs for bitcoin, Standard Chartered analsyt says Ether.fi thwarts domain account takeover attempt, confirms user funds safe Despite the Bans, Chinese Investors Are Not Giving Up on Bitcoin! They Poured $75 Billion into It! Here Is Why FET Price Could Be Getting Ready for a New All-Time High More China stimulus may fuel bullish sentiment in crypto and risk assets: QCP Capital 85% on Polymarket betting Ethereum won’t see new all-time high by 2025 Tokenized asset market to hit $10T by 2030: Chainlink report BitcoinOS launches BitSNARK ZK verification for enhanced privacy on Bitcoin Initia raises $14 million Series A at $350 million token valuation Video: Unpacking Justin Sun’s messy WBTC deal with BitGo Bitcoin (BTC) Continues to Struggle for $64K, Investors Are Hesitant! But Standard Chartered Is Upbeat About the Rise, Here's Why! Been scammed? ‘Crypto crimestoppers’ claim to help get crypto back Biggest fears about Bitcoin’s future: Industry weighs in Solana (SOL) Price Secures 2021 Bull Run Support, Eyes Explosive Move Email auto-reply vulnerability allows hackers to mine cryptocurrency Dogwifhat (WIF) to $80: Epic Top Solana Meme Coin Price Prediction Revealed Bitcoin ‘Ready’ to Blow Above $68,000, Says Uphold Head of Research Bitcoin Evangelist Saylor Wants You to Say These Words in Elevator Binance Coin (BNB) May Be Poised for Historic Price Breakout Ahead of CZ's Release The Fed Pivot is Finally Here 5 Things to Know About Binance’s Telegram Game Moonbix Ethereum's Changing Landscape Stablecoins Will Drive Institutional Adoption in Asia: Chainalysis CEO Dogecoin (DOGE) Skyrockets in Key Metric With $1 Billion Milestone Toncoin (TON) Price Prediction for September 25 What’s Next for 'Hamster Kombat' After Airdrop? Expanding Beyond Telegram SHIB Price Prediction for September 25 Israel Goes Cashless Former Government Employees, Compliance Officers Rally for Detained Binance Executive Ripple CEO Notes Two Catalysts Required for XRP Price To Fly in SEC Document Binance introduces pre-market trading, enabling users to trade tokens before official listings ETH’s Path to $3K Involves Maintaining This Critical Support (Ethereum Price Analysis) ETH/BTC Ratio Surge May Push Ethereum Price Above $2,900 Theta Labs launches tool converting smartphone GPU to mine TFUEL tokens Hermetica brings its synthetic dollar USDh to Stacks Crypto Community Speculates on Hamster Kombat (HMSTR) Listing Price Whale Makes Bold Move With $1.29M in POPCAT After Losing $611K in the Same Token Do Kwon was leverage in South Korea airport deal, ex-minister claims Altseason alert: Here’s why Altcoins are about to boom XRP Price Closing in on $0.70, Breakout Expected Soon Chainlink nears make or break price amid strong ecosystem growth FED's Interest Rate Cuts Are Driving Bitcoin Higher, But Are Negatively Affecting These Two Altcoins! Here's Why! Binance Introduces Fixed Rate Loans: Details Binance Announces Revolutionary New Altcoin Service! Bitcoin Price Stumbles As Investors Anticipate $65K, Is BTC Correction Brewing? 'World Doesn't Need Bitcoin,' Says Schiff Will Shiba Inu Price Hit $1 if SHIB Rallied Like in 2021? XProtocol’s Ethereum Phone XForge Launching to Take on Solana Seeker Nomic brings nBTC to Berachain, enables direct BTC conversions on Artio testnet Satoshi era Bitcoin moves for the first time in 15 years ? CELO jumps 25% after gaining endorsement from Ethereum co-founder SHIB Thief Nears Endgame: $230 Million Stolen Funds Almost Gone Top Analyst Says Crazy Days Are Coming for XRP Odds of Bitcoin price soaring to a new all-time high are rising: Polymarket Bitcoin Whales Accumulate $219M worth of $BTC in Major Binance Withdrawals Kraken Kicks Off Crypto Sponsorship with Bundesliga’s RB Leipzig The price of Bitcoin on the rise Circle aims to own crypto compliance space while Tether questions 'price' of current regulation Huddle01, Blockchain Video Conferencing Project That Seeks to Outdo Zoom, Targets $37M Node Sale Dogecoin (DOGE) Eyes Biggest Price Breakout, But There's a Catch Mt.Gox Repayments: Will $8 Billion Flood Crash the Crypto Market? Assetera to Use Polygon to Secure Transactions and Use Stablecoins for Purchase, Clearing, and Settlement to Ensure Fast and Efficient Process Celo Overtakes Tron in Stablecoin Usage Thanks to App Adoption in Africa BlackRock buys this much Bitcoin since start of 2024 Ethereum Eyes $3,000 Breakout Amid Bullish Pennant Formation Bitcoin Price Rises And Reaches The $65,000 Threshold Whale dumps $3 million worth of INJ and buys LDO ? Visa to help banks test tokenized assets, smart contracts Unbelievable Incident in Diyarbakır! Her Boyfriend Set a Trap and Stole Her 54 Ethereum (ETH) Worth 125 Thousand Dollars! Ether has lost one-third of its bitcoin value in a year U.S. M2 Money Supply Approaches New Highs as Financial Assets Reach Record Levels Ripple (XRP) Price Prediction and Outlook for This Week Dogecoin Cofounder Breaks Silence on Satoshi Bitcoin Speculations Is Sui (SUI) Price Setting its Track for a Massive Bull Run? New Axie Infinity Updates: Faster Fortune Slips and More Features Watch Out for Friday in Bitcoin: There is a $5.8 Billion Earthquake! Deribit CEO Warns About Volatility! Mark Cuban: Kamala Harris Opposes SEC’s Regulation by Enforcement Approach ARB surges as Arbitrum completes major ArbOS 32 upgrade, extending weekly gains ‘Was it worth it?’ Polkadot reveals six-digit expenses in crypto event JASMY price breaks downtrend: can bulls reclaim key level? Brink Donates Over $1 Million To Bitcoin Developers Last Year Hamster Kombat gears up for Binance launchpool listing amid controversies Bitcoin's South Korea Discount Hits Highest Since October 2023 EOS Network Achieves 1-Second Finality Through Spring 1.0 Update POPCAT hits all-time high as market cap surges past $1b Shiba Inu (SHIB) on Verge of Becoming Profitable Again Solana-Based Popcat Hits $1 Billion Market Cap, New ATH, What's Next? Crypto Prices on September 25: BTC Breaches $64K, Sei Up 24%, POPCAT Soars 13% 5 Essential Reasons to Stay Bullish on XRP, According to Industry Expert Justin Sun Thinks China Will Spark a Crypto Bull Run – Here’s Why Solana Price Forecast: Here's Why SOL Comeback Will Be Explosive A Fire Alarm Interrupted an Aussie Crypto Summit. The Symbolism Wasn't Missed by a Concerned Industry Bitcoin Price Signals Market Hesitation, But Here's Why Standard Chartered Is Still Optimistic 10x Research Reveals Top Altcoins Savvy Crypto Traders Are Betting Big On! Crypto Mom Hester Peirce Backs Repeal of SAB 121, Calls it an Unnecessary Burden on Industry Popular Analyst Says Bitcoin Rally Begins in October, Reveals Monthly BTC Price Prediction! Points to This Month for ATH! Solana Flag Breakout Eyes 60% Rally to $239 Target: Details $EGLD Taps into Chainlink’s Next-Gen Oracle Solution with Real-Time Data Feeds Litecoin, Kaspa price outlook as BTC holds $63k Solana meme coin takes off with SOL 15% TVL jumps FCA Wants to Tighten Grip on Regulated Firms to Better Shield Customer Cash Dogecoin Founder Says He Will Never Make Any (Meme) Crypto Again Expert Predicts XRP Price if Ethereum Hits $10K, Solana $950, and BNB $1700 Dogecoin Price Prediction: DOGE Price Breakout Ahead? The Sandbox and Smobler Launch Virtual Universal Peace Sanctuary Beyond Traditional Currency: A Vision for a More Human-Centric Economy Glassnode Co-Founders Say Crypto on the Verge of Altcoin Season – Here’s Their Timeline Michael Saylor Weighs in On BlackRock's Ultra-Bullish Bitcoin Statement Bitcoin sell-side risk hits 2024 low just $10K from BTC price record Shiba Inu Shares New Update Regarding Phase 2 Launch of Shiba Eternity Pro crypto trader announces ‘epic pump season,’ here’s when Golem report reassures no ETH dump after $337M transfers Ethereum ICO Participant Wakes Up After 9 Years of Dormancy A Bitcoin wallet from the Satoshi era has been awakened: could it be true? MENA received $338b value in crypto as the 7th-largest market South Korean Police Bust Crypto-Fueled Drug Operation, Seizing $465,000 in Narcotics Crypto Mom Says SEC Should Have Admitted Earlier That Crypto Assets Aren’t Securities Themselves Bitcoin (BTC) Flashes 'Head and Shoulders': $90,000 Incoming? Ocean Protocol Partners with Zero1 Labs to Revolutionize AI and Data Privacy Crypto Market Could Boom with Gensler’s SEC Exit, Says Mark Cuban Expert Predicts Shiba Inu Price if XRP Reaches $200 Sei spikes 25%, breaks key resistance as bulls eye $0.50 SUI Explodes by 12% Daily, Bitcoin Stopped at $65K Again (Market Watch) Kosovo receives guidance from Council of Europe on crypto crime tracing Delist Announcement from Bitcoin Exchange Binance: Two Altcoin Trading Pairs Delisted from Spot Trading! ADA, TIA, WIF see positive sentiment; can they capitalize on it? Blockchain-Based Investment Platform Assetera to Offer Tokenized Assets on Polygon Bitcoin Strength Continues on U.S, China Easing; Floki Bot Crosses Trading Milestone Societe Generale Forge partners with Bitpanda for euro stablecoin ahead of MiCA Cardano Founder Says Everything is Going as Foreseen For Midnight XRP Price Remains in Range: Can It Escape the Consolidation? Analysis Company Reveals: “Miners Stop Selling Their Coins in These Four Cryptocurrencies” Bitcoin's $5.8B Quarterly Options Expiry May Spark Market Swings, Deribit Says Floki's Valhalla Partners with Esports Giant Alliance 4 Crypto Coins To Turn $500 to $5000 After TAO's 100% Rally Altcoin Rally: AVAX Targets $33, TON Eyes $6.33, and WIF Poised for 145% Gain 1,015 Bitcoin Withdrawn from Binance: $64.47M Shifted to New Wallet in Major Transaction Cardano (ADA) Jumps 10%: Is a $0.50 Retest on the Horizon? Bitcoin Dominance Crumbles: Is a Massive Altcoin Surge Ahead? Ripple vs SEC Update Today: Experts Predict 75% Chance of Appeal—Impact on XRP Price BONK’s Bullish Momentum: A Breakout Could Ignite a Massive Rally Over 383M XRP Moved from Bitstamp Activated Address to Single Wallet ‘Patron NFTs’ could be answer to ‘broken’ crypto fundraising model — Kain Warwick FBI Warns of Growing 'Pig Butchering' Crypto Schemes in Maryland Stand With Crypto drops ‘supports crypto’ tag from Harris after backlash Bitcoin Price Targets Higher Levels: Can the Momentum Hold? Neo integrates GoPlus User Security Module into Neo X node US spot bitcoin ETFs mark fourth straight day of net inflows, reaching $136 million Bitcoin surges past $64k as expectations for monetary easing rise SHIB to Hit $0.00003? Analysis Hints at a Potential Rally Thailand kicks off first phase of $14 bln "digital wallet" stimulus scheme Analyst Says Just a Matter of Time Before Altcoin Season, Sees One Coin Mirroring Massive 2021 Solana Surge Ethereum Price Poised for a Comeback: Can It Break $2,700? Here’s How Much Shiba Inu Could Be Worth If Its Price Soars 7,692,207% Like in 2021 BlackRock Bitcoin, Ethereum ETFs notch $158 million net inflows amid market recovery Ethereum is a ‘dictatorship’ claims Cardano founder Charles Hoskinson Crypto to Buy for Short Term: The Power of Bitcoin, Ethereum and Tether in 2024 Best AI Coins Revolutionize Blockchain in 2024 : Fetch.AI, Forta, and SingularityNET Survey Shows 34.6% of Young Investors in Brazil Hold Cryptocurrency in Their Portfolios US accuses Visa of monopolizing debit card swipes How to Earn the Most Diamonds in the 'Hamster Kombat' Interlude Season Chartist Reveals Timeframe for XRP Push to $6.3 Terra Luna Classic Passes Major Proposal, LUNC Price To Rally? 70% of Top US Financial Advisors Now Hold Crypto, Client Adoption Could Follow Soon: Bitwise CIO India’s Enforcement Directorate Cracks Down on Gaming App Scam with Binance’s Support Top 3 Most Trendy Altcoins Amid Price Rallies and Airdops Whale Deposits $47.9M in Bitcoin to Binance in Strategic Move Breaking: US SEC and TrueUSD Issuer TrustToken Settles Securities Charges MoneyGram admits ‘cybersecurity issue’ behind dayslong outage How Paraguay is Redefining Blockchain Sovereignty with Legaledger – No More Gas Fees! Best AI Coins Revolutionize Blockchain in 2024 : Fetch.AI, Forta, and SingularityNET Solana Price Set to Hit $165 Level Soon, Here’s Why BlackRock's head of crypto doesn’t see Bitcoin as a ‘risk on’ asset XRP Ledger Gets Major Upgrade, Will This Boost RLUSD Deployment? Crypto to Buy for Short Term: The Power of Bitcoin, Ethereum and Tether in 2024 Gensler grilled as most ‘destructive’ SEC chair before congressional hearing Bitcoin Network Activity Surges as Old $BTC Tokens Move, Sell-Off Concerns Erupt SEC Faces Backlash Over Alleged Misconduct in Ripple Case Ethereum is a ‘dictatorship’ claims Cardano founder Charles Hoskinson Bitcoin (BTC) Golden Cross Coming, Ethereum (ETH) Reclaims Bullish Trend, Binance Coin (BNB) Breaks 65-Day Resistance Upper vs. Lower Case Fight: $TERMINUS and $Terminus Spike by 1000x and 500x Sky Pauses Plan to Offboard Wrapped Bitcoin, After Chat With BitGo's Belshe Why did Caroline Ellison get such a light sentence? Jupiter to hold vote on JUP tokens from earlier airdrop Next Big Currency: How New Platforms are Shaping the Future of Cryptocurrency 3 reasons why Near Protocol (NEAR) has gained 50% in a month Ripple Issues Largest Batch of RLUSD on XRPL, ETH