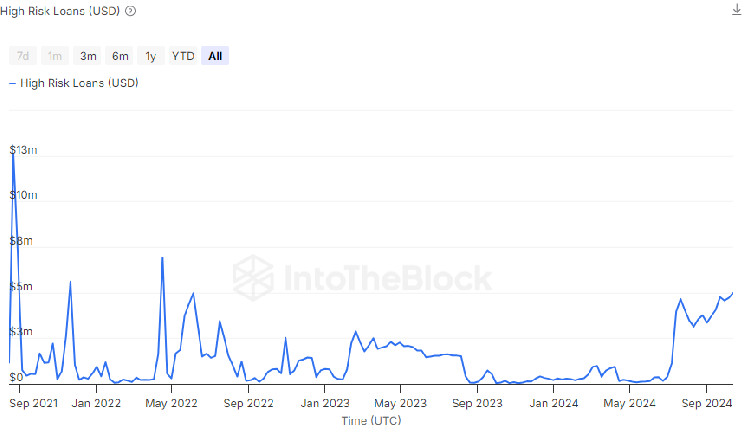

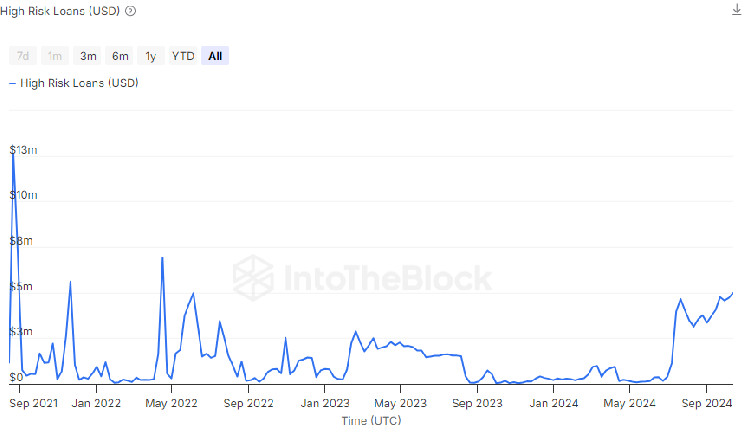

CandleFocus 'High-Risk' Crypto Loans Surge to a Two-Year High of $55M

2024-10-18

Author: Content Editor

The total amount of high-risk loans in the decentralized lending market has reached its highest level in over two years, raising concerns about potential liquidation cascades and market volatility. These high-risk loans are defined as those within 5% of their liquidation price. If the value of the collateral falls by 5%, it will no longer cover the loan, triggering liquidation. IntoTheBlock, an analytics firm, reported that the total amount of high-risk loans rose to $55 million, the highest since June 2022. The surge in these loans can lead to a self-reinforced process of liquidations, lowering crypto prices and causing further liquidations, creating increased market turbulence. Bad debt resulting from these liquidations can negatively impact market liquidity and make it difficult to trade large orders at stable prices.

Related News

Pro-Bitcoin PAC Unveils Donald Trump Campaign Ad Shiba Inu Price Makes End-of-Correction Pattern For 48% Rally Could Bitcoin’s Strong Weekly Gains Signal a Potential Rebound Towards $70,000? Why the Next Federal Reserve Rate Cut Could Spark an Altcoin Bull Market Analytics Company Reveals: These Two Altcoins May Have Hidden Bullish Signs Is Trump just using crypto voters? Harris isn’t so innocent either Crypto events turn to regulation and politics as US election looms Aave Address Count On Optimism Rapidly Growing, Will Price Rise To New 13-Month High? Goatseus Maximus Price Prediction: Will GOAT Rally Surpass $0.5? Anatoly Yakovenko Explains The "Fundamental" Difference Between Solana And Ethereum Market Expert Predicts Bitcoin ETFs To Surpass Gold ETFs, Here's When Rebar aims to launch Bitcoin-native MEV Shield by end of 2024: CEO Will Bitcoin’s Rally Continue? Analytics Company Representatives Speak Out Bitcoin Closes in on Price Peak – $69K Resistance in Sight SEC gives NYSE and Cboe the go-ahead to list options trading for multiple spot bitcoin ETFs Tokenization and Stablecoins Close to Being Regulated in This Latam Giant Memecoin craze fuels Solana price rally — Is $180 SOL the next stop? Bluesky Signups Surge After Elon Musk's Twitter Says AI Can Be Trained on Tweets Before Bitcoin: 4 Early Digital Currencies and Why They Collapsed Can Bitcoin Now Make A New All-Time High Coinbase, Hut 8 lead crypto stocks higher as bitcoin inches towards $70,000 level Bitcoin Whales Prepare for Price Surge, CryptoQuant Reports Anthropic says AI could one day ‘sabotage’ humanity but it’s fine for now Trader Says Large-Cap AI Altcoin Looks ‘Extremely Good,’ Maps Path Forward for Solana, FLOKI, Bonk and Pepe Dogecoin Eyes 30% Surge: $2 Billion in Trading Volume Supports Uptrend Crypto Super PACs spend $1.3M on candidates as early voting continues No, the SEC Isn't Backing Off Solana—Here's the Latest Rising Job Cuts: How Layoffs Are Impacting Bitcoin and Asset Classes Olympic Snowboarder Used Tether in Cocaine-Smuggling Murder Scheme, Feds Say El Salvador Survey Shows Bitcoin’s Lindy Effect in Action Bitcoin (BTC) Tops $69,000. Is 155% Rally Possible? Dogwifhat (WIF) struggles to reclaim $3 amid meme coin resurgence Ethereum (ETH) $6,000 Price Goal Falls Off the Table TON Blockchain Integrates Axelar’s MDS, Expanding Multi-Chain Interoperability Ethereum Bullish Pattern Signals Upcoming Rally – Analyst Sets $2,870 Target Is a new whale on Polymarket skewing odds? $5 Billion Crypto Unlock Could Shake Markets This October When Will Bitcoin Price Go Higher? 6 Experts Share Their Views ? ONDO Spikes 8% as Major Derivatives Exchanges Mull BlackRock's BUIDL as Collateral Option Crypto Trader Nets Over $550K from Free Minting $Daram and $Frogs Tokens Glassnode Co-Founders Say Opportunities Opening Up for Altcoins, Predict Strong Altseason If This Happens A crypto lawyer predicts a ‘dramatic increase’ in memecoin lawsuits Will 'Off the Grid' Take Crypto Games Mainstream? Allegations of Fraud in a Newly Launched Altcoin: Will the Team Airdrop a Massive Airdrop to Itself? BREAKING: Kamala Harris Is Allegedly Considering Two Names To Replace Gary Gensler As SEC Chair – What Are Their Crypto Views? Dogecoin (DOGE) Can "Run" to $1, Top Trader Predicts Standard measure of bitcoin-gold correlation goes to zero Solana Meme Coin GOAT Attracts Crypto Whales After 260% Price Spike Binance Executive's Trial Delayed to October 25 Due to Health Concerns Bitcoin ETFs Rake in $470M, Ethereum Follows with $48M Surge Crypto Whales Bought These Coins in the Third Week of October 2024 Pi Network Gears Up for Mainnet with Node Version 0.5.0 Release Conduit G2’s 100 Mgas/s Sets New Standard for Onchain Games and DEXs Argentina’s CNV proposes new regulations for virtual asset service providers Bitcoin Is Booming—You Can Earn More by Playing These Free Games Crypto.com v. SEC Is a Bold, 'Bet the Company' Case North Korea links suspected in $5 million breach of Tapioca DAO Bitcoin 'Angle Theory' unlocks BTC’s next cycle top Price analysis 10/18: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB 5 Reasons Behind the 400% Spike in NFT Transactions on Telegram in Q3 2024 Do Kwon extradition delayed again by Montenegro Constitutional Court BlackRock Is Allegedly In Cooperation Talks With Three Major Cryptocurrency Exchanges – Here Are Those Three Names Sen. Warren calls out Deaton’s ‘pro-bono work for crypto’ in 2nd debate Marc Andreessen-funded AI bot becomes a millionaire after 'Fartcoin' holdings rally 3 cryptocurrencies to avoid trading next week Bitcoin whale accumulation mirrors 2020 trend where BTC rallied 550% Agrotoken Revolutionizes Natural Resource Commodities with Polygon-Powered Tokenization Bitcoin set to hit six figures amid growing whale accumulation and supply constraints: Bitwise CIO What to Expect Over the Coming Week in Crypto: Scroll Enters the Frame Radiant Capital hacker compromised developers’ devices — post-mortem Bitcoin Miners Stop Selling as Revenue Hits 2-Month High: BTC Eyes New Peak These Litecoin Metrics Surge to Monthly Peaks as LTC Price Rises Above $70 FED Member Waller Makes Hot Statements About Cryptocurrency Sector Putin confirms BRICS will explore digital currencies for investment development Metacade Elevates Web3 Gaming with Coinbase Wallet Integration: Access for 73M Players Shiba Inu (SHIB) Witnesses Mysterious $2 Million Whale Activity on Major US Exchange Analyst: BlackRock’s Bitcoin ETF Will Soon Flip Its Gold ETF Wall Street Will Capitulate to Bitcoin, Predicts Anthony Pompliano 'Solana Killer' Aptos (APT) Celebrates 1.7 Billion Transaction Milestone $1 Billion XRP in 24 Hours: Why Is XRP Price Still Down? Bitcoin Price Analysis: BTC Breaks Above $68,000 as Traders Battle for a Rally to ATH Storj crypto rallies as a golden cross pattern nears Pundit Says XRP May Never Be This Low Ever Again Sei Network Welcomes MoonPay for Seamless Crypto Transactions DNA Fund Acquires Coral Capital, Expanding AUM to Over $50M Odds of Ethereum price rally to $3K increase, but a few red flags remain 5 DeFi predictions for 2025: Rise of AI, Omnichain and BTC derivatives MicroStrategy, Coinbase, and Other Stocks in Green as Bitcoin Traders Become Greedy Maker (MKR) Falls to 12-Month Low, Sets Sights On $511 “Diamond Handed” Giant Bitcoin Whale Loses Patience, Sells After 5 Years! His Profit Is Astonishing! Scroll Team-Linked Addresses Receive Airdrop Points Ahead of Distribution IBX Rug Pull Accusations: Decentralized Exchange Faces Controversy After $24M Presale Coinbase Boosts Leverage to 20x for Perpetual Futures Trading Here’s Why Bitcoin May Not See Lower Prices Bitcoin Isn't at a Record Like Gold and S&P 500, but an Overlooked Catalyst Suggests a Coming Change Ether.Fi Implements Chainlink’s Proof of Reserve for Greater Transparency MicroStrategy's 'Nav Premium' Shouldn't be Feared, Says Benchmark, Raising Price Target to $245 Immutable zkEVM Opens Doors to All Developers with Permissionless Deployment TapiocaDAO Compromised: TAP Token Drops Over 95% 3 AI Crypto Likely To Explode Ahead of Nvidia's November Earnings Derivatives Protocol Synthetix (SNX) Leads the DeFi Sector in Recent Development Activity: Santiment Merlin holds the leading position among Bitcoin L2 chains SHIB Burns Skyrocket on All Time Frames: What's Happening? Binance SEC Lawsuit: Court Issues Major Order on BNB, BUSD Love them or hate them, memecoins are winning either way Chainlink, Avalanche, Injective, and Cardano Poised for Breakout as Bitcoin Consolidates Bittensor Integrates EVM, Bringing DeFi to its Decentralized AI Platform Q3 2024 Progress Report EigenLayer X hackers who likely stole $800K now posting dog pics Bonk (BONK) Breaks Out of Symmetrical Triangle, Analysts Predict 16X Rally Crypto Analysts Adjust Altcoin Portfolios as Bitcoin Clings to $68,000 Phantom Wallet Introduces Token Sharing on WhatsApp and Telegram Hoppy token hits all-time high, rare pattern points to more gains Ripple Price Analysis: XRP Unable to Overcome $0.55, is a Crash Imminent? Crypto Market Takes a Hit: $287M Liquidated in 24-Hour Rollercoaster AI Companions token rises as technicals point to a 45% AIC surge 5 Explosive Altcoins to Rally 100x This Weekend Michael Saylor Names Biggest Regret for Crypto Holders in Epic Bitcoin Post Here’s How High Ethereum Price Can Go by the End of October? Filecoin Expands With 60+ Teams Innovating Web3 and DePIN Solutions Dogecoin Whales Buy 899% More DOGE Amid Meme Coin Price Increase What Can You Do With $96? Smart Trader Invested In This Altcoin, Turned $96 Into $3 Million! Dogecoin Rockets 30% in Key Metric as Price Goes Bullish Bitfinex-backed Plasma raises $3.5 million to expand access to USDT stablecoins on Bitcoin Solana (SOL) Price May Not Break All-Time High in 2024, Indicators Reveal Industry has a ‘long way to go’ in addressing Web3 questions Self-Proclaimed Satoshi Craig Wright Clashes Again With XRP Community, What Happened? Cardano (ADA) Price Prediction for October 18 PEPE Price’s 32% Rally to Four-Month High May Stumble, Here’s Why Shiba Inu Market Cap Surges 43%, Reclaiming $11 Billion After September Drop Ethereum (ETH) Price Prediction for October 18 Dogwifhat price makes a comeback as WIF price rallies 76% in 30 days — What’s next? 'Diamond Hands' Bitcoin Investor Sells BTC After 5 Years of HODLing TON could help DeFi break into mainstream: Report SEC vs XRP: Ripple’s Legal Head Breaks Down Appeal Strategy io.net Collaborates with ParallelAI to Accelerate Decentralized Computing for Generative AI Ethereum-based Operating System ethOS unveils dGEN1 Hardware Device For Blockchain dApp Interaction Radiant Capital Taps FBI To Recover Stolen Funds in $50M Crypto Hack October Boosts Bitcoin Miners' Revenue—But How Will the Election Shift the Market? Will Bitcoin Price Hit $75K in the Next 10 Days of October? Analysts Reveal Their Year-End Expectations for Bitcoin (BTC), Citing Their Previous Successful Predictions as an Example! Why These Altcoins Are Trending Today — October 18 28 Million XRP Dump Stuns Ripple Community Did Jump Trading just ‘Fracture’ the trust of the entire crypto industry? The Bitcoin Mempool Drama Was All Too Predictable Can global regulation keep up with the tokenization boom? | Opinion A New Listing Announcement Came From Bitcoin Exchange Binance! Here Are the Details Gala Games Introduces Tokenized Founder’s Nodes on GalaChain for Transfers XRPL Xaman Wallet Hits Multi-Month High in Key User Milestone Is Tor still safe after Germany’s ‘timing attack?’ Answer: It’s complicated... Gold hits new all-time-high at $2,700 amidst bullish Bitcoin XRP Could Plummet 30% as Ripple Faces Renewed SEC Legal Battle Polkadot Joins Forces with Banxa and Polimec, Bridging Web2 and Web3 Google Search for "Bitcoin" at a yearly low Ethereum on the Brink of Bottoming Out Against Bitcoin, According to Benjamin Cowen – Here Are His Targets Bitcoin Could Hit Turbulence From US Bond Yields, Fed Policy: Analyst Solana Eyes Previous ATH As Top Analyst Says "Market is Poised For Action Post-Halving" Sotheby’s to offer six works by AI art star Botto, a decentralized artist operated by a DAO Litecoin 10% Rally Targets $100 as On-Chain Volume Nears $4B Binance Turns On Mobile Money Payments for Crypto in Six African Countries What is layer-2 in crypto? What is a layer-2 blockchain? Crypto Price Analysis October-18: ETH, XRP, SOL, DOGE, and SUI Polymarket whale raises Trump odds, sparking manipulation concerns Analyst Says Cardano Price Is "Bottoming" After Hitting Two-Year Low Dogecoin (DOGE) price up as meme coins rise EigenLayer X account compromised, shares malicious airdrop link Dogecoin (DOGE) Skyrockets 11% in Hours: What's Driving Surge? This Week in Meme Coins: Hoppy Forms New ATH, BOME, RETARDIO Rally Over 50% Is the ‘Uptober’ Bitcoin rally over? BTC traders turn bearish Popcat (POPCAT) Sees Fresh Buying Pressure, Targets $1.55 All-Time High Shiba Inu FUD Hits All-Time High – SHIB Team Makes Important Statement Northern Data Group’s Q3 Revenue Soars 235% on AI Computing Demand JUST IN! DWF Labs Announces Partnership with a New Altcoin, Price Spikes! Pepe Coin Price Prediction: Analyst Hints "Buy The Dip" Ahead of a Bullish 2025 DOGE Price Expects Bullish Breakout to Previous ATH Soon With Cycle Top Targets From $1 to $10 TunaChain Partners with Collably to Accelerate Blockchain Innovation Crypto market prediction for November 2024 NFT activity on Telegram surged 400% in Q3 2024: Report Top Analyst Says Dogecoin (DOGE) on Cusp of ‘Major Breakout,’ Updates Outlook on Solana Rival Sui and Popcat Global Bitcoin ETPs Register Biggest Seven-Day Inflow Since July Singapore's biggest bank DBS introduces 'Token Services' to enable blockchain-based banking SOL Price Targets $170 as Builder Interest on Solana Doubles Dogecoin Rallies 24%, Targets $0.20 as Social Mentions Skyrocket by 11.48K Apple Should Buy $100 Billion of Bitcoin, MicroStrategy’s Saylor Says Experts Say Bitcoin Weekly MACD and Monthly Trends Flash Green, Confirming Further Gains Fake Coinbase scam lands Indian national in prison for 5 years Strategic approaches to digital asset management Shiba Inu Surges 42% in 30 Days: Bullish Trend Targets $0.00000252 Ripple CEO Says XRP Will Be One of Crypto Winners $1 Million Bitcoin Surprise Epic Statement Made by Samson Mow POPCAT jumps 13.6% as analysts eye new highs Dogecoin (DOGE) Explodes 8% Daily, Bitcoin (BTC) Eyes $68K (Market Watch) Bitcoin Price Prediction: BTC Maintains Its Bullish Momentum Shiba Inu Bulls Buy 2.95T SHIB Worth $53M in a Day as October Flips Green Morgan Stanley’s Bitcoin ETF holdings surge to $272.1M amid rising crypto demand UAE to introduce legal framework for DAOs Wintermute accumulates GOAT from top whale wallets SEC’s Ripple appeal doesn’t challenge XRP non-security status US Treasury used AI to recover $4 billion in fraud over past year Toncoin Price Braces for Major Volatility as These Investors Step Back BTC price set to break 7-month slump as Bitcoin ETFs hit $65B record EthOS introduces dGEN1 hardware device for Ethereum onchain interactions Dogecoin and Bonk Rally, But Experts Warn of Market Correction Cardano (ADA) Eyes a Potential Recovery: Can It Bounce Back? Analyst Sets XRP Price Target if BTC Hits $80K in Next 3 Months Solana content tokenization grows with Cube listing of Access Protocol following Argentine government partnership Keplr Partners with Starknet: Revolutionizing the Web with ZK Rollups and Account Abstraction Dogecoin (DOGE) Strengthens Ground Amid a 9% Price Jump XRP Community Explores Native Staking on XRPL, with Contributions from Flare and Ripple CryptoPunks collection to be featured in 800-page book documenting phenomenal rise What’s Behind Solana Price Drop Today? Top 5 Blockchain Protocols For End-to-End Transaction Security Dogecoin Moons Again After Musk Drops Token Mention During Pennsylvania Town Hall Mountain Protocol Integrates Chainlink CCIP for USDM Stablecoin Bitcoin, Ethereum to See $1.62 Billion Options Expire: What It Means for Prices 'High-Risk' Crypto Loans Surge to a Two-Year High of $55M Ethereum’s Pectra fork adds dynamic blob fees to to improve L2 scaling BlackRock's spot bitcoin ETF draws in over $1 billion so far this week World unveils new layer-2 network 'World Chain' Best Cryptos to Buy for 2024: This Strategy Could Maximize Your Profits Is Liberland the key to crypto’s true revolution? IOTA Grants Update: 29 Projects Awarded $3.6 Million to Transform Tokenisation, Invoicing, DEXes Cardano Price Faces Uncertainty, Here’s What’s Likely to Follow BitBoy Says XRP Still Set to Moon Despite Latest SEC Move Against Ripple Stacks ($STX) Launches on Nexo Platform, Unlocking Bitcoin-Powered Smart Contracts DWF Labs Expands Platform with Options Trading for Web3 Assets Bitcoin Exchange OKX Announces That It Has Delisted Another Altcoin Trading Pair! Donald Trump Crypto Assets Surge by $6.1M in 2024 With Memecoins Dominating Bitcoin Exchange Binance Announces It Will End Pre-Market Trading for This Altcoin and Launch Spot Trading! US SEC Officially Appeals Ripple Ruling Over , $XRP Dips Bitcoin to pump if oil, energy prices surge amid Middle East tension: Hayes SEC targets Ripple’s XRP sales on exchanges, distributions of XRP to employees in new filing Alchemy Pay Partners with CKB Eco Fund to Streamline $CKB Purchases Best Cryptos to Buy for 2024: This Strategy Could Maximize Your Profits Is a gently used 2001 honda civic ($USEDCAR) the next super memecoin? Bitcoin Analyst Predicts Final Correction Before All-Time High Push Fantom (FTM) Price Shows Signs of Slowing After 14% Weekly Surge Smart Money Nets Millions: Big Wins with PEPE, SPX, MOG, and WOJAK Crypto Goes Mainstream: Blackrock Boosts North America's $1.3T Inflows XRP Price Analysis: Can it Break Out of Channel B and Rally to $1? US has 26M strong ‘crypto voting bloc’ ahead of elections — Survey Russia’s Central Bank Report Spotlights Ripple Potential Despite SEC Appeal VeChain (VET) “Turbo Trigger” Activated? Price Could Reach $1 China’s Stock Rally Takes a Toll on its Crypto Market Memecoins drove Tron network revenue to new high over Q3: Messari Top Bitcoin Gatherings of 2024: Where Crypto Minds Converge Unveiling the Hidden Threats: Critical Blockchain Security Flaws Exposed Best Cat-Themed Meme Coins Today Hot Trends MOG and More Nearly 70% of institutional investors commit to Ethereum staking – survey Sheffield United Partners with Solana Meme Coin MANEKI for the 2024/25 Season Best Staking Crypto Coins Of 2024 Blockchain For Earning Income The Most Promising Cryptocurrencies in Q3 2024: Bitcoin, Ethereum, and Beyond Ripple Joins Forces With the IRC to Help Crisis-Affected People (Details) Shiba Inu (SHIB): Get Ready for Golden Cross, Solana (SOL) on Verge of Failing, Ethereum (ETH) Fights With Major Resistance Level FTX Token (FTT) Leads Market Gains, But It Does Not Mean Much Bank Of America Says Gold Is The Ultimate Safe Haven, What About Bitcoin? Why Did SEC Miss Crucial Ripple Appeal Deadline? US SEC Spokesperson Confirms To Proceed With Appeals in Ripple Lawsuit Ripple CEO Brad Garlinghouse Provides Clarity On RLUSD, XRP ETF, SEC Lawsuit, IPO Telegram gaming sees NFT and user engagement boom in Q3 2024: report Binance is the top exchange for Ripple’s XRP whales Could Arkham’s derivatives exchange really challenge Binance?