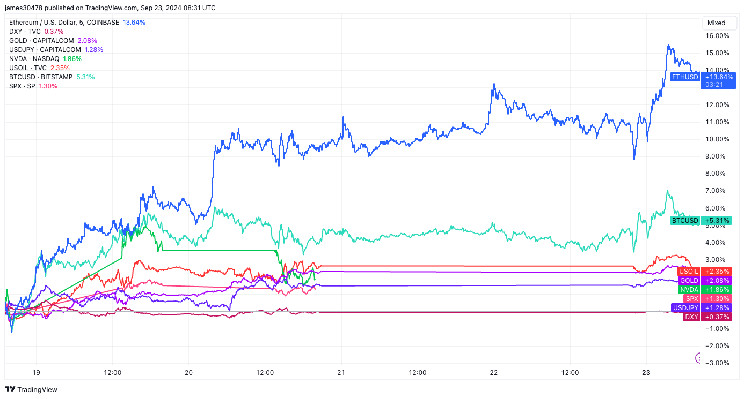

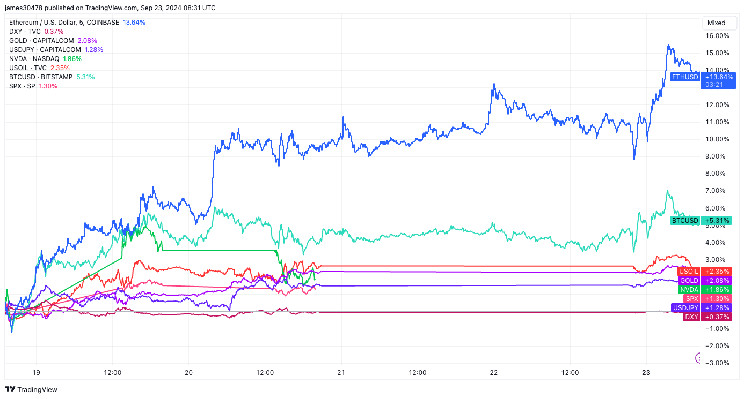

CandleFocus Ether Leads Post-Fed Crypto Market Rally as Yen Weakness Sparks Risk-On Frenzy

2024-09-23

Author: Content Editor

The U.S. Dollar Index has climbed above 101 as the yen weakens, fueling risk-on momentum in the market. Ether has skyrocketed 14%, with meme coins leading a 40% surge, while bitcoin has gained but lost market dominance. Additionally, oil has jumped 2% due to tensions in the Middle East, gold has rallied, and Nvidia and the S&P 500 have seen increases amid the risk-on wave. The Federal Reserve's decision to cut interest rates by 50 basis points has sparked debate, with concerns that it may signal an impending recession, but others suggest a balanced economic environment. The crypto market has rebounded significantly, with ether and bitcoin ETFs seeing inflows. Small-cap cryptocurrencies have emerged as the biggest winners following the Fed's decision, reflecting an increase in risk-on sentiment. Looking ahead, there is an even split in the CME Fed Funds futures on the probability of a 25 or 50 basis point rate cut in November.

Related News

Polymarket explores token launch amid $50 million fundraising talks Arthur Hayes Buys $4M Worth of Aethir (ATH) After PENDLE Selloff Litecoin Circulating Supply Hits 75 Million NEAR Protocol Price Jumps 15%, Eyes $10 as Next Target Crypto Products See $321,000,000 in Institutional Capital During Second Consecutive Week of Inflows: CoinShares Republicans urge SEC to drop SAB 121 crypto accounting rule Coinbase, SEC present case to appeals court in petition for rulemaking case Ethereum Price At Risk? Foundation Continues ETH Liquidations Federal Judges Skewer SEC for Refusing to Answer Straight Questions on Bitcoin, Ethereum Top 3 Reasons Why Arthur Hayes Selling PENDLE For ATH Token Has AAVE Price Hit Overbought Levels After a 30% Weekly Surge? AI tokens lead weekly gains after Fed's interest rate cut Diamond Hands Shiba Inu Whale Switches to These 2 Crypto Mango Markets Mulls CFTC Settlement Over Crypto Trading Violations AI-Related Cryptos Lead Altcoin Surge; Bitcoin Breakout Nears with Several Catalyst in Q4: Analyst Bitcoin could continue to consolidte under $65,200 in the near term – Bitfinex BREAKING: The Most Popular Platform of the Last Days Announced That It Will Issue Altcoins Solana Records a Lower High of $152; What's Next for SOL? 'NFL Rivals' Delivers Fun Mobile Football With Just the Right Level of NFT Integration Biggest Crypto Gaming Tokens Launched in 2024—So Far BNB Price Prediction: A New All-Time High SOON? KPMG Calls for Better Custodial Solutions to Enhance Bitcoin’s Institutional Adoption US SEC, Coinbase clash in court over crypto rulemaking SEC approval of BTC ETF options to ‘attract more big fish’ “Bitcoin Could Be Preparing for a Significant Surge,” Analyst Says, Explains Why Grayscale Sees Crypto at the Heart of $80 Trillion Baby Boomer Wealth Transfer Gold and Bitcoin ‘Very Well Positioned’ for Rallies Amid Worsening US Fiscal Predicament: Macro Guru Luke Gromen Telegram Game X Empire Airdrop Soon: 12.5M Users Eligible Xandeum: Scaling Solana with Decentralized Storage Solutions IOTA Ecosystem Spotlight: The Community Behind Blockchain Innovation Illuvium Price Falls After Major Sell-off by luggis.eth Metaplex unveils indexing and data availability network for Solana Ethereum’s Balancing Act: Bullish Momentum vs. Foundation Selling Pressure Celestia Price Surges 10% Following Major $100 Million Funding: Is $10 Next For TIA? Aurory AI x Orbler: Driving Web3 Innovation Supposed Hamster Kombat co-founder launches new game Solana (SOL) Eating Ethereum's Big Share Ex-Coinbase CTO: ‘Fed wants you dead,’ Bitcoin counters state control Binance Founder CZ to Leave Jail This Week – Will Bitcoin Price Surge? Bitcoin Price Has One Concern, Reveals Legendary Trader Peter Brandt Binance Issues Important Upgrade Alert to Crypto Users Game On: Azarus Founder Alex Casassovici Talks Web3 Streaming and Blockchain CEO of Bitcoin Mining Giant Marathon Predicts Energy Market Disruption TRON Meme Coin Creators to Receive TRX Airdrop, Justin Sun Says Hamster Kombat backlash: why users are boycotting one of the most-hyped crypto games Ethereum Bulls, Buckle Up: VanEck Expert Reveals Crucial Market Update $STRDY Takes the Lead with a Remarkable 120.5% Increase in September 23 Crypto Rally Telegram's X Empire's sells 60,000 NFTs: Achieves 40M Users Cryptocurrency trader turns $800 into $1.3 million in two weeks TAO, POPCAT, AR lead altcoin rally as Bitcoin moves closer to all-time high Unstoppable Domains and Somnia Partner to Boost Digital Identity in Web3 ? Top 10 Bitcoin Holders: Exchanges, Corporations, and Governments Dominate the Charts Two FED Members Speak! One of the Most Hawkish Members, Kashkari, Revealed How Much Cut He Expects in the Next Meetings! Bittensor's TAO leads AI token rally with 56% gain amid market rebound Solana TVL declines, but will SOL price react negatively? BREAKING: Coinbase Announces Third Altcoin Listing – Here’s That Unexpected Altcoin! JUST IN: Coinbase Futures Announces New Altcoin Listing Investment managers eye ‘extraordinary upside’ from BTC options debut Is Bitcoin's Rise Real? Analyst Makes Reference to 2021, Announces New ATH Prediction! JUST IN: Coinbase Listings Just Won’t Stop – Now They Announced They Will List A Surprise Altcoin On The Spot Market Ethereum and Cardano Co-Founder: Trump the Favorite for Crypto, but the World Moves on Without the U.S. The crucial role of Artificial Intelligence (AI) in Bitcoin mining Whale Deposits 49,001 BNB into Binance Through Venus Ethereum gains 15% in a week — Is a recovery to $3K back in sight? Blockfi Receives $250M USDC Deposit, Sparking Hopes for Creditor Repayments Bitcoin’s bottom slowly erodes as whale wallets increase by 3% JP Morgan's Onyx Blockchain Used for Siemens' Digital Commercial Paper Settlement Threadguy shouts one question at Trump, Polymarket calls it an interview Trader Joe rebrands to Let’s F***ing Joe Blockchain Data-Availability Project Celestia's Foundation Raises $100M Digital Asset, DTCC complete collateral tokenization pilot Analyst Predicts Shiba Inu Breakout to $0.000045 from Symmetrical Triangle Pattern Telegram’s Privacy Overhaul: IPs and Phone Numbers of Lawbreakers to Be Shared Bybit Türkiye Gains Recognition as a Crypto Asset Service Provider by Turkish Regulator Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA After Friend.tech’s failure, SocialFi must ‘cross the chasm’ to succeed XRP Dwarfs Cardano, Ethereum by Weekly Institutional Inflows Michael Saylor Issues Epic Bitcoin Prediction Using Just 2 Words ARKM up 27% as AI tokens surge 14 Years On: Satoshi Nakamoto's Vision for Bitcoin Payments Echoes Bittensor’s 18% Surge: A Sign of Broader Crypto Market Recovery? Analyst Predicts 8,500% Rally For Cardano To Reach $31 As Indicators Turn Bullish NFT Market Leaders: ApeCoin, Axie Infinity, and More Capture Attention VeChain Bears Dominate but Analyst Sees Breakout to $1 or $2 BTC, ETH and XRP Price Prediction for September 23 Will SUI, SOL, WLD, IMX, ZETA Prices Crash As Major Unlocks Are Upcoming? Weekly Crypto Standouts: CEL’s 339% Surge, BNX’s 15% Decline BlackRock Bitcoin ETF demands 12-hour BTC withdrawals from Coinbase Bitcoin’s new price targets of over $80K may not actually be the 'all-time high' Bitcoin gears up for ‘transition phase’ as parabolic rise looms, trader highlights 21.co adds Chainlink Proof of Reserve for 21BTC transparency Bittensor surges by 90% in 7 days: Can it reach $645 now? TON-based wallet to support crypto assets on Tron Bitcoin Forks: Pathways to Innovation or Disruptive Forces? How a GameStop Customer Won a Full Bitcoin in a $33 Pack of Trading Cards Hong Kong monetary regulator launches second phase of CBDC project Neiro, Immutable X, Arkham pumps as Bitcoin stalls Pundit Says Money Flow Entering Shiba Inu as Robinhood’s SHIB Stash Grows 28% to 47T Tokens 3 Reasons to Buy BNB Coin Before Binance Founder CZ's Release Number of Bitcoin millionaires soar by 25% in 2024 Will XRP Price Hit $24-$31? Analyst Shares Elliot Wave Insights Crypto Traders Alert: BTC Nears Critical Level – $70K Within Reach Caroline Ellison Most Likely Won't Serve Time, Polymarket Traders Bet Stacks Revolution: How It’s Transforming the Bitcoin L2 Ecosystem Fast! Solana’s POPCAT Poised for Mega Breakout, On-Chain Metrics Hint at Buy Opportunity QCP Capital Evaluates Bitcoin After Kamala Harris’ Statement of Support INX and Backed expand tokenized stock offerings for Non-US investors Crypto Fight Night: Tron’s Justin Sun Ready to Battle Vitalik Buterin Blockchain Disrupts the User-Generated Content: Can Creators Regain Control? Jupiter price pulls back amid encouraging DEX volume metrics After the Token 2049 Event, Altcoins Started to Rise! Will History Repeat Itself? Here Are the Details Token2049: A circus of crypto and commerce Bitcoin (BTC) Investors Attention: These Two Levels Are Very Critical! There is a Risk of $1.2 Billion! Bitcoin Price Analysis: BTC Bull Run Incoming? Here’s the Next Critical Target 252 Million XRP in Epic Whale Activity, Is It Enough? $6.75 Billion in Solana (SOL) in 24 Hours - Something Big Coming? Riot Platforms and Bitfarms reach settlement agreement to end acquisition bid Bitcoin Could Surge Thanks to Looser Financial Conditions Next Major Solana (SOL) Price Target Revealed by Analyst Web3 gaming firm Immutable criticized for limited phishing warning Sygnum Unit Receives Liechtenstein License as a Crypto Asset Service Provider Is ID Price Crash Incoming as Space ID unlocks 61M Tokens? XRP Forms Golden Cross: Could XRP Price Rally Be Next? Crypto and US stocks show record correlation as Fed policies align markets Powerledger Integrates with Solana to Drive Clean Energy and ReFi Litecoin Circulating Supply Reaches 75 Million, Only 9 Million Coins Remain to Be Mined Whale Activity Sparks Ethereum Market Shift as 8,510 $ETH Transferred to CEXs XRP Could Be Classified Differently, Says Tokentus CEO at Germany Stock Exchange Bitcoin Technical Analysis: BTC Consolidates, Signaling Potential Breakout Here Are Projected Timelines for Cardano Price to Reach $0.50 and $0.60 Ethereum Technical Analysis: ETH Trades Above $2,600 Amid Strong Market Activity AAVE price surges to 2-year high Donald Trump Says Crypto Has a Great Future, Teases Possibility of Paying US Debt With It How High Could Dogecoin Price Go If Elon Musk's X Uses DOGE Payments? Ethereum’s $2,868 Breakout Compromised by Whale Selling 'Uptober' looms for crypto as Tether's market cap hits a record high Can Worldcoin (WLD) Break Resistance After Recent Market Rally? Ethereum Price Analysis: Bulls Eye $3,000 as Next Target as ETH Charts 14% Weekly Gains Altcoin Bull Run: How to Profit from the Next Big Crypto Rally Crypto Young Investors: BaFin Study Reveals over 50% Trust Social Media and Finfluencers Bitcoin Historical Trend Foreshadows Epic Rally in Q4: Details Ripple Prepares for Stablecoin Launch With New Burns DeFi TVL reaches 1-month high, leading protocols surge NEAR Protocol Eyes $6 Amid Network Growth Nearing 1 Million Accounts Ethereum Gas Fees Soar 314%! But Why Are Users Vanishing Amidst the Surge? Fluence Network Launches Staking Program to Build a Cloudless Future On-Chain Data Highlights TON’s Impressive Growth Potential Shiba Inu Burn Rate Spikes, SHIB Price Eyes 36% Rally To $0.00002 Next Weekly Price Review: TAO, IMX, SUI, POPCAT, APT JUST IN! Binance Announced Its New Altcoin Listed, There Was a Huge Jump in Price! STEPN GO and Adidas launch the new Genesis NFT collection BabyDoge Jumps Over 20% Amid Binance Thailand Listing Here's What $100 Invested in Bitcoin, S&P 500, & Gold in 2010 is Worth Now WisdomTree report: the impact of the Fed rate cut on the crypto market Is Bitcoin Gearing Up for A Bullish Q4? The Signs Are There First Shiba Inu (SHIB) Trend Reversal Signal Appears Stablecoins and crypto are threatening fiat money dominance in Eastern Asia Crypto Analyst Ansem Reveals Top 10 Meme Coins For Up to 100X Gains Core Scientific, on Cusp of Becoming a Major Force in AI Hosting, Initiated at Buy: Canaccord Ether Leads Post-Fed Crypto Market Rally as Yen Weakness Sparks Risk-On Frenzy Monero Nears Major Supply Zone at $180: Technical Analysis BTC.com To Rebrand Itself As ‘CloverPool’ New ATH Statement in Bitcoin: Analyst Gives Date for ATH! Altcoin Insights: A Crypto Analyst’s Take on the Current Market Upswing Will EOS Price Hit $1 Ahead of Spring 1.0 Hardfork? Beware of WhatsApp Scams – And How to Report One When You See It SUI Eyes Potential Pullback As RSI Flashes Warning: $1.4 Retest In Sight Bitcoin Has Lots of Reasons to Rally—How High Do Analysts Think BTC Will Go? Ripple News: Is It Safe Buying XRP Through Grayscale Trust Amid a 10% Chance of SEC Appeal? Bankroll Status Faces $230K Loss from DualPools Hacker Assault Peter Schiff: Everybody Missing This Because of Bitcoin CUDIS Partners with Jupiter Exchange to Expand Wellness Services on Solana Cardano Founder Responds as Developer Introduces Bitcoin to Cardano Bridge VeChain Recognized as a Major Player in Europe’s Expanding Blockchain IoT Market Analyst Confirms Shiba Inu is Ready, as Symmetrical Triangle Breakout Targets $0.00008841 BlackRock Bitcoin ETF Options to Set Stage for GameStop-Like 'Gamma Squeeze' Rally, Bitwise Predicts Near Protocol targets $8.5 despite encountering resistance AAVE Breaking Out After Two Years of Consolidation, Eyes ATH Asian Bitcoin Advocate Charges Japan to Acquire 167,000 BTC Cryptocurrencies to watch this week: TokenFi, Arkham, Neiro, Bluzelle Spot Ether ETFs record weekly net outflow of $26.26 million Bitcoin Eyes $69K as Halving Year Patterns Boost Bullish Momentum Bitcoin poised for potential rally as FTX payout looms and Fed shifts Memecoins: A Risky Asset Class With Extraordinary Profit Potential 3 Free Crypto Airdrops for the Fourth Week of September: All You Need to Know Crypto community seeks more clarity from Harris, sentiment under Trump win would be stronger: Bernstein Dogecoin (DOGE) Rally Toward $0.13 Hits Another Setback WILL DOGS Overcome Its Bears After Hitting All-Time Low? Bitcoin’s Strength Prompts Arthur Hayes to Explore Meme Coins Bittensor (TAO) Skyrockets 80% Weekly, Bitcoin (BTC) Stopped Ahead of $65K (Market Watch) These Altcoins Have Much More Users Than PEPE – But Why? Bitcoin core dev to ‘unite’ Bitcoin and Ethereum with cross-chain tunnels Shezmu Hack Unveiled: How $5M Was Stolen and Partially Recovered R. Kiyosaki’s bold prediction: Bitcoin to $500k in 2025, $1 million by 2030 Shytoshi Kusama Shuts Down Hater With Epic Ryoshi Vision Message Bitcoin Is “Best Thing to Happen to Fed,” Schiff Says RSI hints at classic BTC price breakout — 5 things to know in Bitcoin this week Bitcoin (BTC) Holders Stands to Gain $145 Billion if Price Hits $68,000 ‘Bears’ Last Stand’ – Crypto Analyst Unveils Two Potential Bullish Scenarios for Bitcoin (BTC) From players to stakeholders: the growing trend of community tokenization in gaming Bitcoin ETF Options Approved: Is a Major BTC Price Surge on the Horizon? Is Ethereum Poised to Break Through the $2.7K Barrier? SHIB Burns Skyrocket 772% as Price Is on Verge of Breakout Expert Says Do Not Sleep on XRP as Millions Can Be Made with XRP Parabolic Explosion Render Network Gains Momentum: Analyst Predicts a Massive Surge to $150 Binance Labs’ Recent Investment: What is OpenEden? Dogecoin Ready for a Big Move: Top Experts Predict 91% Surge to $0.21 Soon? Bitcoin Price Prediction: How High Can BTC Price Surge by DEC-2024? Over $160 Million in Liquidations as Bitcoin (BTC) Got Rejected at $65K Bittensor Price Prediction : What’s Next After a 131% TAO Price Rally? XRP Fails to Hold Above Key Level. Does It Matter? Sanctum Joins Forces with Jupiter Exchange to Innovate $SOL Payments Interesting Remarks for Binance CEO CZ from Renowned CEO: “His Crime Was No Different From SBF” Shiba Inu Issues Critical Warning After Rug-Pull on Shibarium BNB Price Tops $600: Can the Rally Continue? Unfair Hamster Kombat Airdrop Got Community Furious Australia to require crypto firms to hold financial services licenses XRP Rejected at $0.60, but Cup and Handle Formation Suggests Imminent Rally XRP Price Breakout to 30% Rally Next as Investor Inflows Explode Gold hits new high as Bitcoin rallies to month high at above $64K John Deaton Confirms Debate Date With Senator Elizabeth Warren Crypto’s ‘March to Remember’: A Look Back at the 2023 Crackdown Ether Outperforms Bitcoin as Token 2049 Concludes, Overall Crypto Market Stays Flat Barry Silbert Predicts Coinbase Listing Will Be 'Game Changing' for TAO Terra Luna Classic Burns 726 Million USTC from Anchor Protocol – Price Rally Coming? SOL/ETH Price Analysis: Will Solana Price Reach $160 This Week? Is it a Good Idea to Buy XRP below $0.60? SUI Targets $3 As TVL Hits $900M & Mimics SOL’s 2021 Bull Run Kamala Harris on Cryptocurrencies: Taking A Step Away from Anti-Crypto Senator Warren Bitcoin Reaches 25D High as Whales Trade and Shorts Liquidate Bitcoin’s (BTC) Rally to $80,000 May Be Short-Lived as Greed Overtakes Investors Aave Community Split on WBTC Amid Justin Sun-Related Transparency Fears Vitalik Buertin reveals 2 issues to solve after Zuzalu ‘popup city’ experiment Here Are Projected Timelines for Shiba Inu to Reach $0.000272 and $0.00341 XRP Price Could Soon Surge: Can Bulls Fuel the Rally? $PENDLE Skyrockets: Coin of the Day with an 18% Price Surge How China's Economic Slowdown Will Transform Global Trade, Expert Insights Breaking: Kamala Harris Challenges Donald Trump to Another Debate Amid Crypto Policy Talks Hot Altcoins and Trades Right Now: $PENDLE, $TAO, and $SUI Tops the List South Korean Lawmaker Sells $85,700 in Bitcoin Amid Political Scandals; Others Join in Liquidating Crypto Assets Did Ripple’s Victory Over the SEC Kickstart the Long-Awaited Altcoin Season? Dogecoin Eyes 45% Gain: RSI Surpasses Trendline, Whale Activity Supports Breakout Ethereum Price Breaks $2,600: Is More Upside Ahead? Here’s XRP Price If Bitcoin Hits $13M as Predicted by MicroStrategy Chairman Crypto Lobbyist Charged With Breaking Campaign Finance Rules Carrot Swap launches xUSD, a USDC- and USDT-backed stablecoin, on Neo X Pendle Price Back On Track As Derivative Traders Step In Kamala Harris finally breaks silence on crypto: Report Bitcoin Rises to Test One Month High as Rate Cut Euphoria Fades Bitcoin Price Regains Strength: Is a New Rally Brewing? Long-term Ethereum investor reaps $131.72 million profit after two-year hold AAVE Price Eyes $200 As Bulls Take Over: Right Time To Buy? ‘Work, Retire, Repeat’ – Half of American Retirees Do Not Have Enough to Be Retired: Report Pendle Price Rally Continues Despite High Volume Sell-Off by BitMEX Co-founder Kamala Harris Courts AI, Crypto Industries During Fundraising Event in New York MKR Price Stalls Near $1600: Can It Fend Off Further Decline? Will Bitcoin (BTC) $70,000 Attempt Fail? Massive XPR Triangle Breakthrough is Here, Ethereum (ETH) Bullish Dynamic is Fading ‘Easy Multiples’ – Trader Predicts Rallies for Layer-1 Altcoin, Says One Memecoin Gearing Up for Big Breakout AI Narrative Crypto Projects Leading the Charge: $INJ, $FET, $TAO Dominate The Funding: Crypto VCs on a fundraising spree Diamond Hands Strategy Nets $131.72 Million Profit for Ethereum Investor XRPKuwait Expands XRP Ledger Connectivity with Two New Hubs