CandleFocus Bitcoin, Gold May Be Sensing Monetary Debasement as Records Beckon

2024-09-20

Author: Content Editor

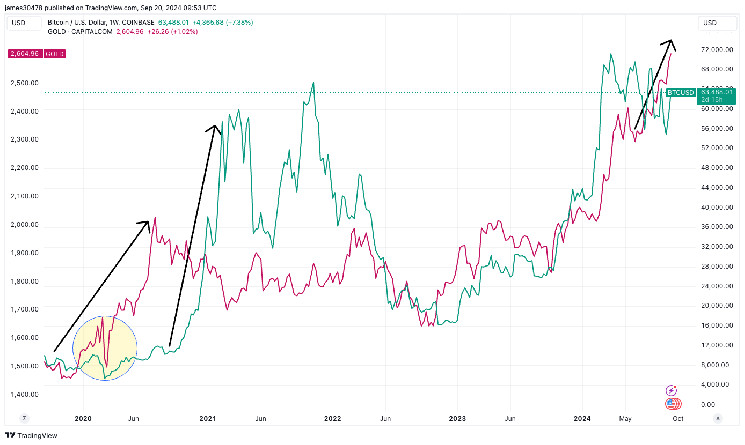

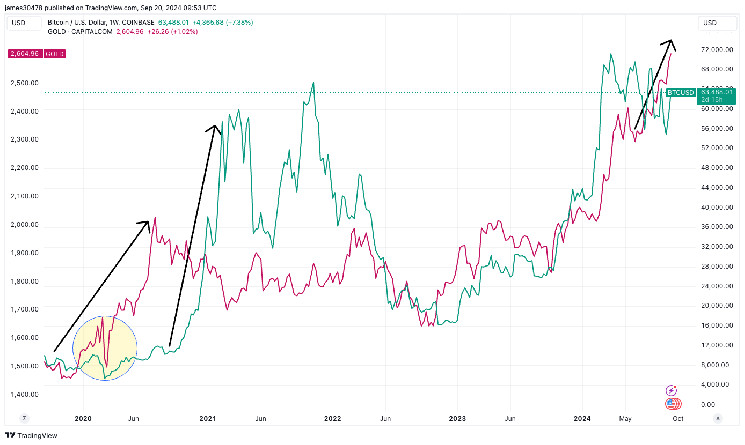

Bitcoin and gold have both seen significant price surges in the past five days, with bitcoin breaking through $64,000 and gold surpassing $2,600 an ounce. This can be attributed to increased global liquidity caused by expanding central bank balance sheets and the Federal Reserve's recent rate cut. Gold has historically been seen as a hedge against uncertainty and monetary debasement, while bitcoin's price tends to move in line with liquidity trends. The combined balance sheets of the world's 15 largest central banks now approach $31 trillion, providing further stimulus for both assets.

Related News

Securitize adds Wormhole for multi-chain RWA tokens Crypto Biz: Circle prepares to debut on Wall Street Aptos partners with Ignition AI Accelerator to boost APAC AI startups Arkham Unveils Over 1,250 Core Scientific Bitcoin Wallets: A Transparency Milestone Sui’s Market Spikes, Challenges Cardano’s Dominance Whale Spends $4.5M USDC to Buy More WIF at $1.76 Boosts Holdings to $57.4M Phantom Unveils Embedded Wallets at Global Solana Conference For Simple Crypto Onboarding Sky expands native tokens to Solana with Wormhole NTT Post-FTX world needs ‘next-generation’ exchange, ex-Coinbase exec says Bank of Canada just says no to retail CBDC in reshuffling of priorities Crypto Price Update September 20: Terra(LUNA) vs. Terra Classic(LUNC): Can Bulls Step In? Real World Assets Market Soars to $6.68B, Revolutionizing Traditional Investment Crypto Exchanges Battle Against Scams Floki Price Poised for 60% Rally? Team Launches Revamped Marketing Efforts This Month How Bitcoin Will React After The U.S. Election Solana prepares for possible ‘sizable’ move after defending $120 support BingX confirms the resumption of withdrawal services following hack Elon Musk starts to comply with Brazilian court orders, suspends accounts on X Altcoin Market Cap Climbs Above $600 Billion: Is This the Bottom? 'Kamala Harris presidency might be even better for Bitcoin,' say VanEck analysts Price analysis 9/20: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB Avalanche targets institutional adoption as crypto projects seek use cases What to expect at Caroline Ellison’s sentencing hearing Ethereum open interest hits 20-month high: Bullish or bearish for ETH? Do Kwon’s extradition case goes back to Montenegrin justice minister Will Altcoin Season Begin? Analytics Company Gives Its Opinion Cryptocurrency Statement from Visa: “The Future Will Be Different” MicroStrategy's Saylor Shares Stunningly Bullish Bitcoin Rumor Hashpower Evolution: Bitmain's New ASIC Packs 477,677% More Power than the 2013 S1 Cathedra Bitcoin Announces Non-Brokered LIFE Offering to Purchase BTC FET Price Poised for $2 Surge, On-chain Data Confirms Strong Buy Signal SEC Approves Options Trading on BlackRock’s Spot Bitcoin ETF IBIT Did Arthur Hayes dump the project he shilled at Token2049? SEC seeks sanctions against Elon Musk over Twitter investigation ASI Alliance ‘quite far’ from OpenAI in hardware — SingularityNET CEO Bull cycles spark ‘some seemingly rational reason’ to compromise security: Ledger exec Hashgraph Association to explore digital asset use cases with Qatar stakeholders Speculation and DeFi will drive Ethereum network activity if bull market persists, analysts say Bhutan’s $750M revenue from Bitcoin mining sets model for developing nations NFTs have symbolism that memecoins cannot replicate: Pudgy Penguins CEO "It's Pathetic": Ripple CEO Lambasts Scammers SHIB Price Prediction for September 20 Japan’s Metaplanet Stock Skyrockets 443% with Bitcoin Strategy in 2024 Crypto Analyst Says Downtrend for Top Ethereum Rival Is Over, Maps Path Forward for Bitcoin and One AI Altcoin Bitcoin analyst eyes $40,000: 'Prepare for the crash' 3 Reasons Why Bitcoin Bulls Should be Careful Next Week Crypto scammer hit with $36 million fine by CFTC for fraud “The Next Few Days Are Crucial for Bitcoin,” Analyst Says, Reveals Critical Level to Maintain Fidelity adds 5K Bitcoin in the past week, now holds nearly 1% of all BTC What is the Future of Ethereum? What Happens to ETH in the Event of a General Rally? OpenSea NFT Marketplace Hit With Class Action Suit Over Alleged Securities Sales Bitcoin Price and Hashrate Divergence May Set the Scene for a Potential Rally, Historical Data Shows Iggy Azalea to Release Online Casino Motherland in Boost for MOTHER Token Top Stablecoins Dominate with $171.03 Billion Market Cap Crypto Exchange Bybit Announces Catizen ($CATI) Listing Dogecoin (DOGE) price enters parabolic phase, targets $2 42 coins have outperformed BTC year-to-date: Lookonchain DOGE Price Prediction for September 20 Bithumb’s Bank Switch Under Review by South Korean Regulator Cardano Bears Stun Bulls Amid Fight for Rebound XRP to $4.20? XRP Sees Tightest Bollinger Bands Since 2016 DWF Labs Partners with GraFun to Revolutionize Memecoin Market on BNB Chain BEAM Price Targets $0.01800 Breakout As Bullish Pattern Emerging Ripple CTO Reveals What's Next for XRP Price: Details $1 Billion in 24 Hours for Bitcoin (BTC): What's Happening? Capital inefficiency is crippling DEXs Solana Price Analysis: What’s Keeping SOL Below $200? iMe Smart Platform Responds to BingX Security Breach, Plans $LIME Token Buyback Santa Monica Bitcoin Office Case Study to be Presented at CMRTA Annual Conference AI Meme Coins Rocketing: Check Out Top Gainers Bybit improves security with AI Risk Engine Michael Saylor Breaks Silence on BlackRock Bitcoin Whitepaper Coinbase Premium Negative Again: What Does This Mean? Economist Peter Schiff Urged to Invest in Shiba Inu After Missing Bitcoin Opportunity XRP Bollinger Bands Get Thinner, Analysts See Possible 65,000% XRP Rise Bybit reveals over $940m in abnormal withdrawals during H1 2024 DeFi Education Fund CLO: Positive Crypto Sentiment is on the Rise Top Analyst Predicts POPCAT Price If Market Cap Hit $2B VET News: VeChain’s New Patent on User Identity Authentication Data Approved by US Patent Office Nic Carter revisits Operation Choke Point 2.0 after bombshell Silvergate testimony Analysts reiterate ‘buy’ rating as Hut 8 inks $125m deal Cardano Price Rallied 166% In Q4 2023, Will History Repeat? MicroStrategy Announces Massive $460M Bitcoin Buy Vitalik Buterin Clarifies Key Fact About “His Pet Dog” That Inspired New Coins Is Avalanche (AVAX) Poised to Break Through $30 Soon? A ‘speculative appetite’ may push memecoins higher: GSR Shiba Inu Rockets 115% in Whale Activity Amid Major SHIB Price Breakout Brett Rises From The Ashes: Eyes 26% Gains Above This Level Top Expert Forecasts Dogwifhat Price Could Hit $5 Soon Bitcoin Price Prediction October: Is a New All-Time High on the Horizon? Pendle Price Breaks Below $2? Arthur Hayes Flee Signals Bigger Drop Ahead Citibank, the Fourth Largest Bank in the US, Turned to This Altcoin! Satoshi-Era Bitcoin Miners Awaken En Masse Within One Hour – What’s Happening? Breaking: MicroStrategy Completes $1.01B Offering of Convertible Senior Notes Due 2028 Can Ethereum (ETH) Leverage Bullish Signals to Spark a Rally? Telegram Faces Ban In India After Hacker Uses Chatbots to Leak Insurer's Data 'Catizen' Telegram Game Reveals Airdrop Pass as CATI Token Launches Massive 150,000 ETH in 24 Hours: Ethereum Sell-off Imminent? According to Analyst, FED Is Not the Only Reason Behind Bitcoin's Recent Rise! Here Are Other Factors Supporting the Rise! GPU cloud computing: Aethir announces crypto support for the Filecoin network Bitcoin, Gold May Be Sensing Monetary Debasement as Records Beckon Ethereum Foundation Stuns Community with Big New ETH Sale Legendary Trader Peter Brandt's Solana (SOL) Prediction Ends up Extremely Successful Solana Outshines Cardano: SOL Surges, ADA Lags in 2024 BNB Rides Bullish Wave After 100-Day SMA Breakout, Next Stop $605? Cat-Themed Memecoins Emerge as Preferred Risk On Bets With 40% Surge in a Week Here’s Why Meme Coins WIF, FLOKI, BRETT, BONK, PEPE Are Pumping Hard Today Cardano’s Hoskinson warns Trump-backed crypto venture could harm industry Late Night Legend David Letterman Passed Over for Jury in Crypto Fraud Trial Strategic investment: VCs are missing out on Africa’s blockchain boom | Opinion Shibarium Transactions Spike 267% in Days, SHIB Price Reacts Brazil police bust $9.7b crypto laundering scheme TON Blockchain and Oracle Partner to Revolutionize DeFi Ecosystem Binance Announces a New Altcoin to List on Futures – Incredible Surge in Price Threshold Network Integrates Chainlink Feeds to Strengthen tBTC Ecosystem Across Four Top Blockchains Societe Generale's EURCV looks to Solana for stablecoin success after PayPal’s PYUSD rise Polkadot Upgrade Ushers in a New Era of Efficiency and Scalability for the Ecosystem Franklin Templeton to Launch Mutual Fund on Solana Blockchain Market Volatility Ahead: $48.5 Million in Cliff Unlocks Loom Breaking: Anthony Scaramucci Says Kamala Harris Developing Crypto Policies What Would Ethereum Price Be If Total Crypto Market Cap Hits $15 Trillion? Renzo and Jito Launch ezUSDC on Solana Bitcoin Price Analysis: Why September Could Be a Game-Changer! Binance Suspends EOS Transactions for Upgrade Bitcoin supported by elevated risk-on sentiment as yen weakens against the dollar: analyst BlackRock-backed Securitize integrates Wormhole for cross-chain tokenization Bitcoin (BTC) on Verge of 'Lower High' Reversal at $63,000: What's Happening? Cardano Price Surges 8.46%, Targets $0.42 as Bullish Momentum Grows Bitcoin Whale Offloads $64M in $BTC as Price Soars Past $63K Terraform Labs Gets Court Approval To Wind Down Operations, LUNC & LUNA Rally Ripple Vs. SEC : The Appeal Deadline is Approaching Crypto Price Analysis September-20: ETH, XRP, ADA, BNB, and SOL Where to put $5,000 in crypto to make you a millionaire in 2025 Whale Activity Surges for Fantom, Immutable X, and BAT After Fed Rate Cut PancakeSwap plans v4 update following $836B trading volume milestone High severity bug in Bitcoin Core affects 17% of full nodes Telegram game Catizen's token goes live for exchange trading amid community airdrop Here’s the Difference Between Buying Grayscale XRP Trust and Buying XRP Bitcoin Hits Critical Make-or-Break Moment at 200-Day SMA: Rejection Could Spell Trouble Ahead Shytoshi Kusama Hints Coming Weeks Will Be "More Interesting" for SHIB Top Trader Says Solana Rival That’s Up 60% in a Week To Keep Ripping Hard, Updates Outlook on Bitcoin and Saga ‘Book some profits’ as crypto expert warns of imminent Bitcoin correction Solana News Today: Franklin Templeton Launches Mutual Fund on Solana Blockchain Crypto.com Locks In PSP Licence from Bahrain, Gears Up for Card Launch Bitcoin (BTC) Price Touched $64K, Solana (SOL) Explodes 9% Daily (Market Watch) Will Bitcoin End September at $70K as Bullish Momentum Builds? Santiment Names Three Cryptocurrencies: “These Are The Top Trends Of The Last 24 Hours” Token extensions are “a big good” reason why PayPal taps Solana for stablecoin, says PayPal crypto chief Over $50M possibly stolen in BingX hack, North Korea’s Lazarus group involved? Analyst Says Shiba Inu Comeback Will Be Huge as SHIB Surpasses $0.000014 Can Avalanche Price Hit $50 During This Rally? What Does Bitcoin Dominance Tell Us? Why Is It Increasing? Here is the Latest Report HNT's Price Surge: Is a $10 Target in Sight? Big Investors Accumulate 380M XRP in 10 Days as XRP Posts 18% Gains Here is Key Indicator Showing Shiba Inu Ready for Big Breakout BlackRock amends Coinbase custody agreement to require 12 hour withdrawals amid debt rumors Ether Is Going to Shine Again, Steno Research Says XRP to hit $1 as FedNow project set to transform Ripple Crypto Prices Today September 20: BTC Hits $64K, TAO & WIF Among Top Gainers Arthur Hayes Deposits 350K PENDLE Tokens On Binance & Bybit! SunPump & DWF Labs Partner to Boost SUN Liquidity, Price Jumps 8% Maryland Police Warn Gmail Users of Phishing Scam Demanding Bitcoin Can Polkadot Price Hit $10 As Bulls Struggle With Traders? Key Opinion Leaders Drive $NEIRO’s Price Surge, Study Finds Crypto news and prices: FET, ALEO, and SEI, market trends and outlook Sundog Price Eyes Breakout to $0.6 Amid New Staking Feature Launch Data Shows 50 Wallets Account for 76% of XRP Ledger Transactions Aptos Price Soars 10% After MEXC Partnership; Is Stability Ahead? Is Bitcoin Poised for a Major Breakout Beyond $65K? Bitcoin Cash Price Jumps 15%: Is This Just the Beginning of More Gains? Bitcoin ‘Really Close’ to Exploding to New All-Time High, Says Analyst Kevin Svenson – Here’s the Timeline Top Trader Predict Avalanche (AVAX) Set for a Big Breakout: Can It Reach $45 Soon? Watch these BTC price levels as Bitcoin taps $64K DEX aggregator Jupiter acquires SolanaFM, Coinhall Tether’s transparency and business structure raises $118B FTX-like concerns Jump's 'Frankendancer' Validator Client Is Live on Solana Mainnet Supreme Court of India YouTube channel hijacked to shill XRP Bitcoin and Ethereum ETFs Experience $35.39M and $11.41M in Outflows Bitcoin ETF Inflow Soars: Will BTC Price Break $65K Resistance This Weekend? SocGen's Crypto Unit Takes EURO Stablecoin to Solana After Flopping on Ethereum Eclipse targets October to launch ‘Solana on Ethereum’ L2 Moonriver Coin Powers Decentralized Platforms Crypto Exchange BingX Hacked, Onchain Data Shows Over $43M Drained Solana Climbs Over 10% To Reach Highest Since Late August Huge TRON whale withdrew 60K BTC from JustLend Mastercard, Safaricom Partner on Cross-Border Payments Crypto price predictions: Zetachain, Core, Cat in a dogs world (MEW) Guide to paying taxes on cryptocurrency income Renowned Market Expert Predicts XRP Price for 2025, If BTC Hits $150k To $250K Satoshi-Era Bitcoin Wallet Activated After 13 Years Bitcoin Nears $64K as BTC Futures Attract Billions; BoJ's Hike Pause Bumps Risk Assets US ‘far behind’ on crypto, election no quick fix: Ripple APAC boss AI agents could be policing all crypto txs within 5 years: Chainalysis CEO Impact of Fed Rate Cuts on Crypto Markets, Bybit Executive Weighs In Bi-Partisan Consensus Emerges on Final Day of America Loves Crypto Tour TON blockchain sees explosive 3,435% growth in daily active addresses over 2024 XRP Price Battles Resistance Around $0.60: Will the Struggle End? Can Floki Price Stage a 60% Comeback As Team Revamps Marketing Efforts? AI agents could be policing all crypto txs within 5 years: Chainalysis CEO The Over-Centralization of AI: Is It Time for Decentralized Solutions? This Solana Memecoin Climbs 36%, On The Verge Of Reaching $1 And Record Highs Feds end Bitcoin bandits’ luxury life fueled by $230M crypto scam Bank of Japan keeps rates unchanged after core inflation firm to 2.8% Ethereum Price Reaches $2,500 Again: Will The Uptrend Hold? Polkadot Gains 8% as Agile Coretime Launch Boosts Network Performance Ondo Finance Drives Tokenized Treasuries to New Heights, Exceeding $2.2B in Market Value Bitcoin Price Pushes Higher As The Bulls Set Sights on $65K BingX confirms ‘minor’ losses amid panic over hot wallet movements Crypto Analyst: Bull Market Hinges On This Indicator Reaching 45% Here’s Why Airdrop Enthusiasts Are Turning to These 5 Elite Platforms Crypto Markets to See $1.6 Billion in Bitcoin, Ethereum Options Expire After Fed Rate Cut Bitcoin is showing rising correlation with the S&P 500 Ethereum rallies over 6% following decision to split Pectra upgrade into two phases BingX confirms ‘minor’ losses amid panic over hot wallet movements Crypto Shorts Suffer $147 Million Squeeze As Bitcoin Returns Above $63,000 Coinbase Expands Digital Asset Portfolio with Aleo and Zetachain Listings JPMorgan CEO Jamie Dimon on Fed Rate Cuts: Impact on Economy Likely Minimal Celestia Mainnet Goes Live, TIA Token Price Jumps Over 21% Coinbase and Ripple CLOs Challenge SEC’s ‘Crypto Asset Security’ Terminology Fantom On “Everyone’s Watchlist?” Analyst Explains Why Bitcoin Price Rally Faces Key Resistance: Will Whale Shorts Trigger A Market Pullback? US SEC Commissioner Gives Cautious Nod To Donald Trump's DeFi Project: Report Bitcoin enters ‘bull pennant’ breakout as S&P 500 hits all-time high OKX to Relaunch US Exchange With New App in Late 2024 Bitcoin Reclaims $63,000 After US Fed Rate Cut, But Is This Rally For Real? BlackRock Says Bitcoin a ‘Unique Diversifier’ Amid Geopolitical, Fiscal and Political Risks Dogecoin (DOGE) Shows Trend Reversal Potential, Massive Bitcoin (BTC) Breakout: What's Behind It? Toncoin (TON) $6 Target Extremely Close Crypto Investment Firm Deus X Capital Unveils DeFi Unit Which Will Start New Yield Generating Protocol Bitcoin Bottom Imminent? $1.2 Billion USDT Just Minted by Tether Treasury Making crypto mainstream requires greater efforts to stop fraud Chinese Tether laundromat, Bhutan enjoys recent Bitcoin boost: Asia Express Popcat: Whales On Selling Spree, Can You Hope For Profit Too? XRP Price Prediction: Crypto Pundit Predicts Historical 9,468% Pump To $27 Top DeFi Projects Lead Fee Generation, Uniswap Dominates Unprecedented Growth: Top 5 Bitcoin Futures ETFs Reshape Crypto Landscape Revolut Enters Stablecoin Race: New Challenger to PayPal, Ripple, and BitGo