CandleFocus Where the Demand Comes From as Bitcoin Breaks Through $82K: Van Straten

2024-11-11

Author: Content Editor

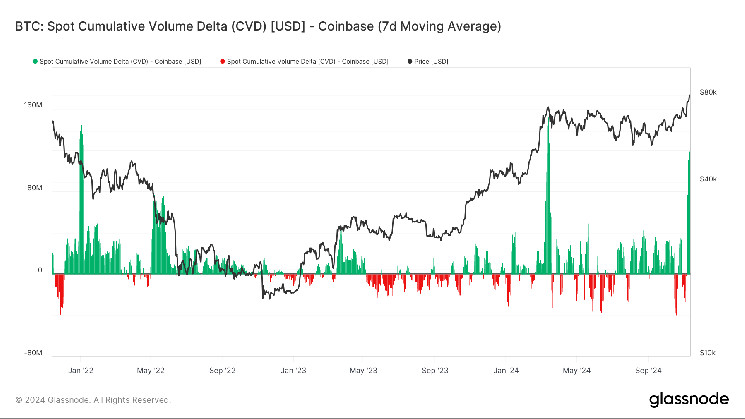

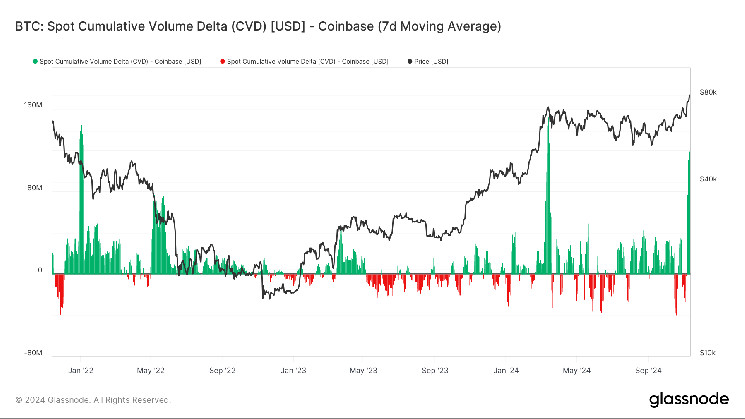

Bitcoin experienced a strong rally last week, posting a 17% gain, its second-best week of the year. The spot volume on Coinbase, a popular US crypto exchange, also surged, reaching levels similar to those seen in March 2024. Additionally, exchange balances for Bitcoin hit a year-to-date low, signaling increased buying pressure. These factors, along with Donald Trump's US presidential election victory, contributed to a surge in cryptocurrency prices, with the total market cap surpassing $2.7 trillion. Bitcoin's market capitalization currently stands at $1.16 trillion, making it the ninth-largest financial asset. To determine if Bitcoin can continue to climb higher, it is important to consider who is buying Bitcoin and whether it is a spot or leverage-driven rally. The Coinbase spot volume and cumulative volume delta (CVD) show significant activity during local highs and lows, with Coinbase frequently accounting for most of the spot CVD. Additionally, there have been discussions about whether inflows into US-listed spot exchange-traded funds (ETFs) are primarily spot buying or part of the basis trade, a strategy that capitalizes on price discrepancies between spot and futures prices. While it was initially believed that ETF inflows were driving the market, Bitcoin has remained relatively stable, suggesting that ETFs have had a minimal impact on price. However, recent spot ETF inflows have outpaced the growth in open interest on the CME futures exchange, indicating increased spot buying. Lastly, data from Glassnode shows that Bitcoin balances on exchanges have reached a year-to-date low, indicating that users are withdrawing their Bitcoin from exchanges in favor of holding or buying more.

Related News

Bittensor (TAO) Price Gains Strength as the Biggest AI Coin Bitcoin Is in Price Discovery Again—How Much Higher Will It Go? Trump's Crypto Renaissance Could Accelerate Latin American Adoption, Experts Say Gold Bug Peter Schiff Urges Traders to Buy His Ordinals Amid Bitcoin’s Surge Toncoin Price Eyes $15 as Elliott Wave Theory Signals End-of-Correction FTX filed for bankruptcy 2 years ago — What’s happening now? BlackRock bitcoin ETF hits new daily volume record as BTC pierces $88,000 2x MicroStrategy ETF Shoots 52%, Clocks $1B Trading Volume Bitcoin Reaches Historic $88,000, Outpaces Silver’s Market Cap The MicroStrategy of Dogecoin? This Firm Is Amassing DOGE as a Treasury Reserve Asset Advisor to Investors with Hundreds of Millions of Dollars of Wealth Talks About Bitcoin – What Do the Ultra-Rich Think About BTC After the... Bitcoin Businesses Feel Safe In The US In Wake Of Trump Victory What Trends Are Emerging for BNB and Others? What to Expect After the Big Rally in Bitcoin Price, What Will Come? Here’s What Experts Say Trading Volume Explodes in 5 Altcoins in South Korea Amid Massive Rally – Here’s the List POPCAT is Inches Away From a New All-Time High Following 15% Rise in a Day Bitcoin Entering ‘Price Discovery’ With Best Yet to Come, According to Crypto Analyst – Here’s Why Tether Unveils WDK: Simplifying Non-Custodial USD₮ and Bitcoin Integration for Developers Ethereum Bottom Against Bitcoin Likely Very Close, According to Analyst Benjamin Cowen – Here’s Why Bitcoin Foe Peter Schiff Made a Statement After the Big Surge: Assesses Scenario of US Government Buying 1 Million BTC Axie Infinity Teases New ‘Nightmare Parts’ for Axies in a Spooky Holiday Update Bitcoin breaks $87k; here’s what this analyst says about BTC price BONK Volume Reaches $1 Billion, Yet Price Faces Hurdles After 43% Surge Solana Price Hits 3 Years High With New ATH CLOSER Than Ever XRP Price Prediction: Will XRP Reach $1 After Bitcoin Frenzy? AAVE, GMX, UNI & More: Arbitrum’s DeFi Giants Leading TVL Rankings Solana price hits 2+ year high — Is a new SOL all-time high on the way? Bipartisan crypto legislation more likely to pass under Trump, but 'will not be an initial priority': TD Cowen AVNU Unveils Game-Changing Community Token Initiative for a Safer Starknet Why Dogecoin Price Is Surging: Breaking News and Price Analysis for November 2024 Cronos Price Soars 30%: Will Momentum Lead to ATH? Bitcoin price spike triggers unprecedented short liquidations, breaking August record Floki Inu Soars 30% After Breaking Key Market Trendline Dogecoin’s $0.27 Resistance: Can the Meme Crypto Break Free and Ignite a Bullish Breakout? MicroStrategy stock hits all-time high after 24 years Dogwifhat (WIF) Price Set To Skyrocket 2,500%, Predicts Renowned Economist Giant Whale May Have Got FOMO – He Bought Huge Amount of Bitcoin at Peak Price – Or Does He Know Something? 'X Empire' and 'Rocky Rabbit' Telegram Game Tokens Pump to All-Time High Prices Ethereum Price Is Getting Ready For Its Major Breakout EVER 7 Reasons Why U.S. Bitcoin Reserve Could Backfire Big Time! Remembering FTX: How the collapse shaped crypto’s future Important Pivotal Bitcoin (BTC) Data Shared by Bloomberg's Mike McGlone Bitcoin Price Skyrockets to $85K. Could It Hit $850K? Binance's CZ Makes Major Statement as Bitcoin Hits $86K The Race Is On To Frontrun The U.S. Government Bitwise CIO: Election removes crypto’s remaining ‘reputational risk’ Status (SNT) and Ardor (ARDR) rally as Bitcoin (BTC) surge strengthens bullish sentiment Okto Wallet teams up with AggLayer to help cross-chain transactions Truflation launches GameFi Index to track hottest gaming tokens Crypto slang explained: a definitive guide Whale Sells $ACT at $36K Loss, Missing Out on a Potential $830K Jackpot ? Prediction markets now give Bitcoin a 52% chance of reaching $100K in 2024 WazirX Rebalancing Calculator shows users missing out on Bitcoin’s $81K all-time high Hedge funds and venture capital firms expect Solana will hit $600 this cycle – Survey Bitcoin Blazes Ahead, But Altcoins Steal the Show – Is ‘Altcoin Season’ Finally Here? Former Alameda co-CEO Sam Trabucco to forfeit $70 million and a yacht in proposed settlement with FTX bankruptcy estate Pepe Coin Price Poised for 30% Upswing in Bullish Rally Avalanche Bounces Back But Fails To Break Above The $33 Level Bitcoin market sees increased call premiums as traders bet on post-election upside Ethereum’s (ETH) Year-to-Date High of $4,095 No Longer Out of Reach Bitcoin trader say BTC headed toward $125K by New Year’s Even based on ‘Bayesian probability’ Bitcoin hits new high above $86,000 on Trump’s victory hype Blur proposal suggests adding trading fees and eliminating creator fee guarantees Investors see crypto markets peaking in H2 2025: Survey The U.S. Treasury yields dip ahead of the inflation and CPI readings on November 13 Judge denies ex-Celsius CEO’s bid to dismiss fraud, manipulation charges Bitcoin, Ethereum ETFs Add Nearly $2 Billion as Crypto Market Surges Price analysis 11/11: SPX, DXY, BTC, ETH, SOL, BNB, DOGE, XRP, ADA, TON Thank You Donald Trump for Bitcoin's All-Time High Bitcoin hits new $85k high, with just 17% left for BTC $100k record Top Analyst: Tired of the XRP Hype, But the Current XRP Price Squeeze Is Hard to Ignore Why Shiba Inu (SHIB) Bulls Might Break Through the $0.000028 Price Wall Altcoin, Which Recently Airdropped New Token to All Its Users, Gave Good News Again: New Airdrop Coming Why is the Bitcoin Price Continuously Going Up? Will the Rise Continue? Analysis Company Shares the Real Reason Behind the Rally Cronos soars 25% in 24 hours: Is a move to $0.204 on the horizon? Ethereum devs publish EIP-7809 proposal for native tokens Dogelon Mars Price Nears Golden Cross: Is A 73% Jump Coming? SHIB spikes over 60% in a week; What next? Brevis Network, a ZK coprocessor, raises $7.5 million in seed token round Bitcoin Taps $84,995 All-Time High: Market Cap Hits $1.68 Trillion as FOMO Sets In What happened to the top 10 cryptos from when Trump was last president? Coinbase stock surges over $300 with 17% gain in 24 hours DOGE, ADA and SHIB surge past BTC in weekly rally amid expected regulatory changes Bitcoin price gains see 'significant pullbacks' ruled out before $150K Bitcoin hits $85K milestone as Google Trends signals renewed retail interest Shiba Inu rides Bitcoin wave, jumps 18% in 24 hours – Is the rally here to stay? ASIC maker Canaan's stock surges 40% after signing order with HIVE Digital for Avalon A1566 miners 3 Signs That Retail Interest is Rising as Bitcoin Breaks $84,000 Ethereum Transaction Volume Hits $60 Billion, Highest in 3 Months Is Donald Trump's Win Boosting Crypto Appeal To Wall Street Players? MicroStrategy stock jumps to record high following $2 billion Bitcoin purchase Pepe: Can the memecoin hit new ATH as smart DEX traders accumulate? A crypto user sent $25 million to the wrong address and now their tokens might be lost forever ? Bitcoin Climbs Above $84K, Adds Almost $20K in a Week Bitcoin (BTC) Fastest Asset to Cross $1 Trillion 'Binance Effect': Peanut the Squirrel, Act I: The AI Prophecy Meme Coins Skyrocket Why These Altcoins Are Trending Today —November 11 Coinbase App Enters Top 70 in App Store as Bitcoin (BTC) Aims for $90,000 Lido DAO Token Drops Amid Large Sales by Major Holders XRP Just Secured Golden Cross: Details Deutsche Telekom Joins Forces with Meta Pool to Pioneer Decentralized AI on NEAR Protocol Chainlink (LINK) Solves Finance’s Data Problem: Turning PDFs into JSON for Cost Savings Peter Schiff Reacts to Bitcoin's Historic Rise Above $82,000 Sonic X Applayer Surpasses 1 Million KYC-Verified Users, Driving Massive Web3 Adoption on TikTok Golden Cross Keeps Dogwifhat (WIF) on Track to Stay Above $3 Fake News: Trump is not the largest holder of Peanut the Squirrel (PNUT) How is Trump’s World Liberty Financial crypto doing? PEPE Upsurge Stalls At Key Resistance, Eyeing Support At $0.00001152 Trump win sends Bitcoin price to all-time high — and boosts 8 key metrics Seasoned Analyst Says Dogecoin to Surge 7,961% to $23.25 Will XRP finally hit $1 during the current bully cycle? Phoenix Group’s Top Gainers Showcase Impressive Gains in Crypto Market Stunning $3.28 Billion in Bitcoin in Past 7 Days – Something's Cooking? 8.2 Billion Dogecoin (DOGE) Open Interest Comes With Major Catch Historical Trend Hints Bitcoin Price Still 25% Away From November Peak Cardano (ADA) price surges 80%: What's Next? Bernstein Urges Investors to Embrace Bitcoin and Crypto Legendary Analyst Brandt Confirms $240K Bitcoin Target with Rare Technical Indicator Ex-Ethereum Adviser Spots Gary Gensler’s Unethical Crypto Ties Dogwifhat Price Breaks Out as Crypto Pro Sees It Hitting $100 $GOAT Whale Strikes Again: $3.44M Investment Yields $2.8M Profit, Now Chasing $ACT Solana (SOL) Price Prediction for November 11 DOGE and SHIB Price Prediction for November 11 Orderly Network Expands to Avalanche, Boosting Cross-Chain Liquidity Access X Empire price is surging, but a risky pattern points to a 65% crash First Warning Signs Appear for BTC After Surging Past $80K: Bitcoin Price Analysis XRP Liquidation Heatmap Hints at Quick Surge to $0.62 Ethereum Tops Development Activity in the Past 30 Days Interview: Bitcoin is here to stay, asserts CoinDCX co-founder Sumit Gupta Dogecoin Founder Can't Hold in Emotions as DOGE Price Goes 'To the Moon' New annual high for the crypto market capitalization Analyst Predicts 3 XRP Price Targets if Bitcoin Hits $100K, $130K, and $160K CHART: Bitcoin could have turned your $1,200 stimulus check into $14,000 Massive $4.3 Billion XRP Over 24 Hours: Can XRP Spark Rally? 2 years on from FTX collapse, bitcoin tops $82K BTC, ETH and XRP Price Prediction for November 11 ? China’s Nano Labs embraces Bitcoin as payment option 3 Cryptocurrencies That Reached All-Time Highs Today — November 11 Crypto Market Cap Could Ballon to $10T by 2026 Under Trump Administration: Standard Chartered Why Bitcoin's Record Price Rally May Be Choked Between $90K and $100K? CoinShares: Crypto products hit record YTD inflows of $31.3b Top Analyst Warns of 25% Bitcoin Dip Before “Generational FOMO” Drives BTC Past $100K Bitcoin DeFi is the perfect storm for mainstream crypto adoption | Opinion HMSTR Token Skyrockets 83% Ahead of Hamster Kombat Season 2 Cardano Breakout Sprint Surpasses $0.60, Now Targeting $1 VeChain’s Recent Surge: Exploring Potential Trends and Corrections for VET and VTHO Sensational 21 Trillion Shiba Inu (SHIB) in 24 Hours: All Records Are Broken WeFi Unveils Token Generation Event for $WFI on Binance Smart Chain Donald Trump's Bitcoin Strategy Advisor Makes Remarkable Claim: 'This Is Why Bitcoin Is Rising!' 3 Altcoins to Watch in the Second Week of November 2024 AVAX Targets 35% Rally – Key Factors Fueling Avalanche’s Momentum Bybit Savings adds Dogecoin with an APR of 10% for 30 days Binance Hits Big: 17 Memecoins Listed in 2024 Headwinds Are Turning to Tailwinds For XRP – Ripple CEO Flash USDT Scam Exposed: How It Works and How to Protect Your Crypto Assets PNUT rises nearly 9% after debut on OKX platform Ripple Price Analysis: This Is XRP’s Next Resistance Target After Gaining 15% Weekly Dogecoin rockets 60% since election night; Here's why BREAKING: MicroStrategy Purchases $2 Billion Worth of Bitcoin Solana Memecoin ACT Rockets 1,720% on Binance Listing as Altcoin Market Heats Up Pre-Market Trading in U.S. Crypto Stocks Explodes, With MicroStrategy Topping $300 SHIB Price Analysis: Can Shiba Inu Break Resistance and Hit New Highs? With New 52-Week High, Dogecoin Eyes 300% Parabolic Rise to $1 Cardano Price Surge Ends 200-Day Accumulation; Analysts Eye $0.8 Bitcoin Hits New ATH, 14 Years After Trading at Just $0.50 Is Litecoin Ready for a Major 369% Price Rally Soon? DOGE Skyrockets to Three-Year High of $0.28, Overtakes XRP in Market Rankings Where the Demand Comes From as Bitcoin Breaks Through $82K: Van Straten PayPal-backed Mesh teams up with Reown to verify Bitcoin wallets for Travel Rule XRP Ledger (XRPL) Hits Major Burn Milestone: Details ‘Just Getting Started’ – Analyst Unveils Big Dogecoin Target, Sees ‘Crazy Bullish’ Chart for Ethereum-Based Coin Ukrainian Man Falls Victim to $250,000 Crypto Robbery in Thailand Kaspa soars as Bitcoin makes new high above $81k Bitcoin Price Breaks Above $82k: Watch Out For These Key Levels Near Protocol Announces Plans to Build the World’s Largest Open-Source AI Model Immutable Announces In-Game Signature Feature for Web3 Games ? Bitcoin Price Blasts Past $82,000, Sparking ‘Extreme Greed’ in Crypto Market WIF Price: How high Can The dogwifhat Price Go? Bitcoin Exchange OKX Announces Listing of Recently Popular Memecoin! FLOKI Shows Major Strength as the Altcoin Indicates Bullish Patterns and Strong Breakout Signals X Empire (X) Soars Over 80% as DWF Labs Boosts Liquidity with Major Deposits Aptos (APT) displays stability as golden cross forms ahead of massive token unlock There is an “Insider” Claim in the Altcoin Listed by Binance Today! Tron Collaborates with DSA to shape Crypto Policies in US Layer-2 Networks Emerge as the Foundation of a More Expansive DeFi Ecosystem This is Why Cardano (ADA) May Struggle to Maintain $0.60 Level ‘Make IOTA Great Again’: Founder Vows to Propel IOTA to New Heights Dogecoin (DOGE) Reveals 4 Key Survival Tips for Investors Right Now Bitcoin Price Surge: $100,000 Within Reach by November’s End Solana Hits Record $4.28B Open Interest – SOL Breaks 8-Month Price Barrier JPMorgan sees Trump’s Bitcoin and crypto deregulation as a win for U.S. banks Toncoin (TON) Recovery Brings 58% of Holders Closer to Profit Coinbase launches Stand With Crypto advocacy group in Australia All eyes on CPI and Fed, Is a Bitcoin correction coming in? 6 Best Node Sales in 2024 DOGE, SHIB Explode by Double Digits, BTC Charts a Fresh Peak Close to $82K (Market Watch) Nansen scales analytics beyond Ethereum with Bitcoin L2 integration Bitcoin Hits New ATH at $81,888: Market Eyes $94K with Open Interest Near $50B Peter Brandt Spots Rare Bitcoin (BTC) Inverted H&S Pattern, Big Moves Coming? DeltaPrime allegedly suffers second attack, losing over $4.7m Blockworks’ Yanowitz Calls Euphoric Phase, Will AVAX Price Soar 6,000%? Crypto liquidations reach $650m; BTC, ETH enter the overbought zone Shiba Inu Records Massive Increase in Burn Rate This Wall Street Bitcoin Miner Orders 6,500 Canaan Machines in $100M Paraguay Push Here is Why Shiba Inu Surging with ‘Big Bois’ Like BTC and ETH: SHIB Lead Explains Ethereum Price Surges Past $3100; Could $4000 Be the Next Target? JUST IN! FTX Files Lawsuit Against Binance Former CEO CZ, Demanding $1.8 Billion! Ex-Pimco, Millennium execs set up crypto advisory business FTX's Trading Arm Alameda Research Files Multi-Million Dollar Lawsuit Against Founder of This Altcoin! Here Are the Details DWF Labs Teams Up with UCLA on Tokenized Securities Education Can Injective surge to $53? INJ needs to meet THIS condition first Crypto PAC Fairshake faces setbacks as several candidate endorsements fall short COTIUSDT Shows Bullish Momentum Following Descending Resistance Break $80K BTC price chases gold — 5 Things to know in Bitcoin this week Hong Kong’s Real-World Asset Tokenization Push: “Ensemble” Project to Fuel $10 Trillion Market The Future of Polygon? AggLayer Insights from Bangkok Summit Will Ethereum (ETH) Hold the $3K Line or Drop Below? Shiba Inu Lead Pitches This Idea to Elon Musk for Integration into Trump’s Team $DOGE Leads Meme Tokens with $34.2B in Weekly Trading Volume XRP and ADA ETF Filings Predicted by Top Analyst Bitcoin's $80K Rally is Bullish, But Slightly Overstretched as Pullback Risks Still Linger: Godbole Shiba Inu Lead Taunts Cardano Founder After Hoskinson Announces He Would Work With US Government on Crypto SUI Price Surges 60% To Record High Market Cap, What’s Next? Justin Sun Cashes in on Ethereum Holdings Can Polkadot (DOT) Rally to $6.5 After a Long Slump? Cardano Sweeps Liquidity: Can ADA Repeat 38%+ Gains in a Day? Pundit Says Shiba Inu $100B Market Cap Is Confirmed—Here’s the Price per SHIB if This Happens Digital asset popularity hits 99% in Turkey: report Bitcoin hits new ATH surpassing $1.6T market cap Bitcoin in ‘Euphoria Zone’ Hits ATH of $81,800 After $14,000 Weekly Gain Dogecoin (DOGE) Soars 50% In a Flash: Is More Upside Ahead? Uniswap Leads DeFi Projects with 1,262.1 $ETH Burn in the Last Week Bitcoin Hits $81K for the First Time as Bulls Lead Crypto Rally Alameda Research sues Waves founder to claw back $90 million Four Big Crypto Entities Can Take XRP Price to $10 Binance Lists Solana Memecoins ACT and PNUT Today. Hoskinson Extends Olive Branch to XRP Community, Sparking Collaboration Hopes AAVE: Potential To Reach $240 As TVL Hits New ATH Shiba Inu’s 36% Surge Triggers Golden Cross, But Sellers Step In Crypto Punks & DMarket Surging: Here Are The Top 10 NFT Projects By Activity In the Last 7 Days LUNC Shows Massive Bullish Potential After a False Breakout Apple CEO Tim Cook reveals three-year crypto holdings Solana’s 30% Rally Brings SOL to a 3-Year High, Market Cap Rises Above $100 Billion Crypto trader turns a $291 investment into $750k in just 3 days, as many rake in profits in the memecoin space BCH to beef up smart contract capabilities: ‘VM Limits’ and ‘BigInts’ upgrades gain support A Crypto Whale Dumps $2.56M in $FLOKI on Binance Amid Price Recovery Dogecoin, Dogelon Mars predictions: what next for DOGE, ELON? Shiba Inu Price Records Largest Weekly Gain Since Feb, ATH Next? From $70k to $88k: Expert Insights on Bitcoin’s Bullish Future Inside Bitcoin Might Still Crash to Zero, Top Angel Investor Claims How a 'No Questions Asked' Crypto Scheme Became a Federal Target Bitcoin’s ascent to $80K is driven by steady ETF demand, not retail FOMO, says Cameron Winklevoss Infinex partners with Near Foundation to integrate chain signatures Bitcoin to be ‘political imperative,’ owning none ‘a liability’ — NYDIG Mt. Gox-linked cold wallet moves over $2 billion worth of bitcoin to new address: Arkham MicroStrategy's Bitcoin portfolio surpasses $20B, ROI now over 100% Dune acquires a16z-backed smlXL to expand real-time blockchain data offering XRP Price Fights for a Steady Climb: Will Bulls Prevail? XRP and ADA Target $1: Market Trends, Analysis, and Key Drivers What’s Next For Dogecoin Price After 80% Weekly Surge Bitget Wallet launches $20M grant for Telegram Mini Apps Solana Price Analysis: After Surging To $211, Here's The Next Targets Meme Coins Rally Pushes Crypto Market Cap Towards $3 Trillion Shiba Inu (SHIB) to Perform Biggest Price Pump? Bitcoin (BTC) Eyeing $80,000, Don't Miss Toncoin (TON) Bullish Reversal Rally Bitcoin sudden pump to $81K annihilates $180M shorts in half a day ‘Defanging the SEC’ could turbocharge the US economy: Cathie Wood Value Locked in Defi Hits $100 Billion—But Six Giants Hold the Bulk of Crypto Assets IBIT ETF stock forecast as Bitcoin price targets $100k, inflows surge Shiba Inu’s S.H.I.B. Proposal Could Transform US Economy With New Blockchain Ecosystem Goatseus Maximus approaches $1b market cap as GOAT pumps 20% WalletConnect Foundation and Reown establish UX standards framework Will Coinbase Handle Scrutiny and Criticism Over Listing Fees and SEC Charges? Crypto’s Comeback: Are Surging Prices Here to Stay? Ethereum Price Hits $3K Milestone Again: Will The Gains Keep Coming? Bitcoin Nears $82K in Bullish Start to Week; Dogecoin Flips USDC OpenSea users drop securities suit after marketplace demands arbitration Bitcoin Price Hits $80K Mark: The Crypto Bull Run Continues Ethereum's ENS Identity System Set to Launch Own Layer-2 Blockchain Cardano Hits 7-Month High as Founder Eyes Hopeful Role in Shaping Trump Crypto Policy Solana Price Hits 3-Year High—Up 2,500% Since Post-FTX Low a16z crypto says tokens will likely be 'legitimate and lawful' under new regulations Ethereum Whales’ Activity Points to New ETH All-Time High, Analyst Says Crypto greed index taps 7-month high as Bitcoin surges past $81K Who Let the Doge Out? Dog-themed Meme Coins Spike on Trump, Fed-fueled Rally