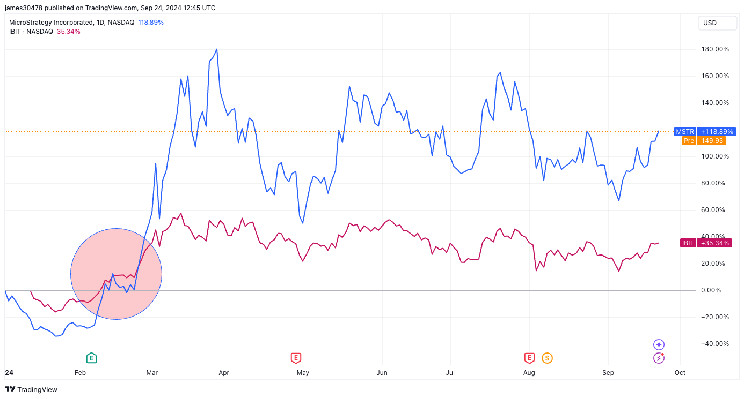

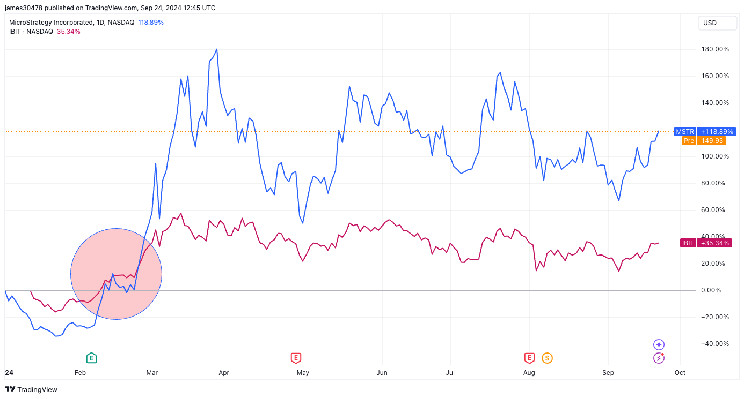

CandleFocus MicroStrategy Outpaces BlackRock's IBIT by Over 3x Year-to-Date

2024-09-24

Author: Content Editor

The launch of U.S. bitcoin exchange-traded funds (ETFs) on January 11, 2024, has been a significant event, with the BlackRock iShares Bitcoin Trust (IBIT) attracting $17.7 billion in net inflows since its debut. IBIT is seen as a competitor to MicroStrategy (MSTR), which holds a substantial amount of bitcoin and has a dual business model. MSTR has outperformed IBIT, with its stock rising 119% compared to IBIT's 35% year-to-date. MicroStrategy's ability to outperform is attributed to its lack of fees for shareholders, revenue generated from its analytics business, and the flexibility to raise capital through debt or equity offerings. MSTR also has better recognition and interest based on Google search trends. However, options trading on IBIT has been approved by the U.S. Securities and Exchange Commission, narrowing the visibility gap.

Related News

MicroStrategy should lend Bitcoin to boost yield — analyst SEC Chair Gary Gensler grilled over crypto regulation, handling of DEBT Box case in heated congressional hearing Caroline Ellison Gets 2 Years in Prison for FTX, Alameda Crimes Bill Maher Exposes Crypto’s “Dirty” Secret Bitcoin bulls are laying the path to $66K, but will they make it? Bitcoin ETFs set to attract liquidity and speculation as IBIT options trading gains approval New Farcaster ‘mini app’ feature launches on web3 social protocol client Warpcast BREAKING: Coinbase Announces a New Altcoin Listing – Comes at an Unusual Time Dogecoin Breaks Above Descending Channel; Is $0.1110 Next? FLOKI Poised for 45% Rally, On-Chain Metrics Flash Buy Signal Bitcoin Pushes Past $64K as Monetary Ease Expectations Grow Dogwifhat (WIF) Targets $2.70 as Solana Meme Coin Competition Heats Up Web3 asset manager Anemoy taps oracle provider Chronicle for real-time data of its onchain Treasuries fund BREAKING: SEC Delays Options Decision for BlackRock Ethereum Spot ETF JUST IN: Binance-Listed Altcoin Makes Important Statement After Alleged Hacking Bittensor Pumps Close 20% As Its Market Cap Explodes Gensler says DEBT Box case ‘not well handled’ by SEC Solana devs weigh proposal to juice validator revenue XRP Price Could Rise By 20%, Hit $0.70 Due to These Reasons ‘Crypto Will Have Ass’: Iggy Azalea Makes No Apologies for ‘Cringe’ Party Telegram-Linked DOGS Ends Airdrop, Prepares for Token Burn Ethereum inflation slashed in half, L2 expenses soar Dogwifhat makes a comeback after WIF rallies 25% in a week — What is next? Top Performing Tokens This Week Across Major Crypto Ecosystems: CEL, STRDY, REEF, OLAS & More How Will Important News from China Affect Cryptocurrencies? Here are the Answers Atua AI and Orbler Collaborate to Drive Web3 Community Engagement Aave (AAVE) regains $20B in net deposits Coinbase's Ethereum network Base silently suffers an outage Celestia (TIA) Price Soars on $100 Million Funding, but Correction Risks Loom Binance Launches Fixed Rate Loans for Stablecoin Lending and Borrowing BlackRock Recommends 84.9% Bitcoin in Portfolios for Higher Potential Growth Animoca Brands, The Sandbox, and Smobler Launch Virtual Peace Sanctuary in Metaverse XRP Highlighted in SWIFT’s Recent Collaboration: What’s at Stake? XRP Whale Moves 30 Million Tokens from Bybit, What’s the Big Plan? Polymarket: Odds of Iggy Azalea lawsuit rise amid online casino plans NEIRO Price Prediction for September 24 Shiba Inu (SHIB) on Verge of Potential 'Uptober' Price Boom: Details Alchemy Pay Partners with Catizen to Simplify $CATI Token Purchases Robinhood to Adorn The Miami Heat Jerseys in Latest NBA Sponsorship Deal What's Next for Toncoin Price After Recent DEX Growth Amid Market Volatility? Avalanche Gets Boost as Citi Files Patent—Can This Drive AVAX Price Higher? AAVE flips key resistance as CEX outflows jump Over $2.5 million worth of rewards in The Sandbox Alpha season 4 3 Solana Based Coins to Buy to Turn $100 to $10000 in October DOGE Price Prediction for September 24 Ethereum Users Face Higher Fees as Onchain Transaction Costs Rise Finance traders will be first to spot superintelligent AI — Wharton prof Near protocol (NEAR) jumps 22% following Nvidia, Alibaba partnership MicroStrategy Outpaces BlackRock's IBIT by Over 3x Year-to-Date Ethereum Mega Whales Ease Selling Pressure with $185 Million Accumulation Dogwifhat (WIF) Tops Crypto Market with 18% Gain, What’s Next? $70K next for Bitcoin? China joins Fed in ‘huge macro event’ Gold breaks all-time high as Bitcoin surges 7% in September in face of economic decline SEC has the tools to provide clear guidelines but chose not to — Commissioner Hester Peirce BREAKING: SEC Sued Two Cryptocurrency Companies! Here are the Details – It’s Related to One of the Most Popular Stablecoins This Is Why Bitcoin (BTC) May Be On Its Way to $69,000 Will Trump pardon SBF? 6 weird Polymarket betting pools on US politics Daylight, ‘onchain for you’ actions recommender, raises $6 million in seed funding BNY Mellon targets crypto ETF custody post-SAB 121 review USDC issuer Circle unveils new compliance tool for programmable wallets BNB and SOL Price Prediction for September 24 Cardano (ADA) Rockets Back into Top 10 With 12% Price Surge HTX reveals the future of Bitcoin DeFi: Babylon staking and fractal scaling Moo Deng Solana Meme Coin Blasts Past $70M Market Cap in Two Weeks $100 Trillion for Binance: CEO Teng Reveals Jaw-Dropping All-Time High 'We are Running Out of Time': U.S. House Democrat Urges Stablecoin Bill Compromise Will XRP Price Breach $0.50 Again? Analyst Flags Weak Buyers Support Bitcoin Price Set to Jump this Week, Real Bull Run Has Not Begun Yet: Analyst Shiba Inu Partner K9 Finance Goes Live on DeFiLlama with $1.05M TVL Pro-XRP Lawyer Exposes Gary Gensler and Senator Warren’s Inconsistent Anti-Crypto Agenda XRPL Wallet Xaman Debuts v3, Introducing Monetization Strategy New Bitcoin Whale Stuns Binance With Staggering BTC Withdrawal Solana (SOL) Price Prediction: September Activity Could Push Price to $160 NodeMonkes Climb the NFT Ladder: Price Pumps Over 65% Fraudsters Impersonate Ripple’s Brad Garlinghouse in Latest XRP Airdrop Scam - CryptoNewsZ $755 Million in 24 Hours for Bitcoin (BTC): What's Happening? Bitcoin mining firm Core Scientific soars to record 248% YTD stock growth Diddy moved into the same jail housing unit as Sam Bankman-Fried Bitcoin eyes $72,000 in October, says Bitget Research analyst Exodus donates $1.3m to Stand With Crypto ahead of US election Cardano ‘flashing the strongest buy signal’ in a month, targets $5 Stock Market Analysts Warned About Bitcoin (BTC): “The Uptrend Has Arrived, But In The Coming Days…” Ripple Price Analysis: XRP Could See Massive Bull Run if it Breaks Above This Level Shiba Inu (SHIB) Skyrockets 171% in Key Metric, Will Price Follow? Bitcoin Rollup Citrea Deploys BitVM-Based Bridge 'Clementine' on Testnet DeFi Protocol Cega Debuts 'Vault Token Market' to Facilitate Seamless Investing ByBit Announces BUIDL Apprenticeship Program For Aspiring Crypto Marketers Chainlink (LINK) Skyrockets 293% in Bullish Whale Activity: What's Driving Surge? Robinhood Crypto Adds UNI, XLM, and XTZ Trading for New York Residents Kraken completes acquisition of Coin Meester B.V. (BCM) Play Solana launches pre-orders for NFT holders> Bitcoin Miner From Network’s Earliest Months is Sending BTC to Kraken BTC to $300,000? Top Trader Delivers Epic Bitcoin Price Prediction Toncoin (TON) Nears 50-Day SMA, Targets 20% Price Surge INX taps Backed to launch tokenized Tesla, Google, and Microsoft stocks on Polygon These 5 Altcoins Are Up More Than 30% in the Past Week Polymarket spurs a sharp rise in prediction market offerings From Niche to Mainstream: How Crypto Can Strengthen Its Derivatives Market GMX price stalls as crypto perpetual futures volume retreats Worldcoin Price Gains Ahead of $58M Unlock Event; Is $5 a Potential Peak? TRON’s Daily Active Accounts Surge 0.56%, Justin Sun Announces TRX Airdrop 90,000 Bitcoin (BTC) Futures Open on Binance: What's Happening? 621 Billion in 24 Hours for Shiba Inu (SHIB): What's Happening? Gala Games token surges ahead of a big ecosystem news Dragonfly Capital Sells AEVO Holdings at a Loss Dogwifhat Price Prediction: WIF Reversal Likely After 77% Downtrend, Is $3 Next? Oasys launches VersePort portal for easier blockchain gaming interactions What to Expect after Fed’s Decision to Cut Interest Rates? JP Morgan’s Onyx Blockchain Used to Settle Siemens Digital Commercial Paper EigenLayer Expects Token Transfer Restrictions to Be Lifted on September 30 Vitalik Buterin Champions Solo Stakers at Home Staking Summit CARV Partners with Base to Transform Data Infrastructure for Gaming and AI HNT Price Triggers Breakout, Can It Grab 30% Gain In One... Is $15 Next For Chainlink Price After Proof of Reserves Integration? Cardano’s ADA Eyes $1: Bullish Analyst Predicts Surge TradingView Analysis Confirms Shiba Inu Path to Long-Lost $0.00003 Level NEAR Achieves Blockchain Sharding, Solving the Blockchain Trilemma CryptoQuant says bitcoin’s 'supply in profit' level signals potential for further gains AI Tokens Outshine Meme Coins as Top Crypto Narrative: Bittensor (TAO) Leads the Surge Cardano Cup-and-Handle Breakout Signals Rally To $0.40 Arthur Hayes Withdraws $1.92M in $ATH from Bybit, Sets Record Accumulation Are Altcoins Set To Skyrocket? Analysts Spot Promising Signs! Folks Finance Expands to Ethereum, Avalanche, and Base With xChain Launch 30 Million XRP Withdrawal Stuns Top Crypto Exchange China Confirms Interest Rate Cut – Will Bitcoin Skyrocket? Dormant Bitcoin Whale Awakens After Decade With 11,507% Gains DWF Labs to debut its synthetic stablecoin by Q1 2025 19 Trillion Shiba Inu (SHIB) Cluster: Here's What It Implies Solana Aims for $172 and $192 with Rounding Bottom Breakout Potential Bitcoin Exchange OKX Announces That This Altcoin Will Support Its Network Upgrade! Here Are the Details Bitcoin Bull Run : Will BTC Hit $400k in the Next Cycle? Render’s market activity balances out after 30% weekly gain: what’s next for RENDER price? Safer, smoother payments can be AI’s ‘killer app’ | Opinion Trump Surges 1% and Harris dips 0.7% in Polymarket Betting JUST IN! Binance Announced Its Newly Listed Altcoin, There Was a Sudden Rise in Price! WazirX Exploiter Launders $12 Million in ETH Through TornadoCash While Bitcoin (BTC) Is Rising, Everyone Is Talking About These Three Altcoins! Here's Why! TON and Curve Finance: a crypto partnership for the future of DeFi Underground crypto mining farms uncovered in Russia's Dagestan Ethereum price surge lifts Lido TVL by 10% despite 26k ETH withdrawals Bitcoin Exchange Binance Listed 6 New Altcoin Pairs, Two of Which Are TRY Pairs! Render and Algorand Break Downtrends, Signals Bullish Reversals Analyst Says Pepe Coin Price Can Surge 5X Despite Ethereum Woes SEC Commissioner Mark Uyeda Opposes Crypto Audit Trials, Here’s Why Turkish Vice President Cevdet Yilmaz: “Cryptocurrency and Stock Tax Plan Halted” Cardano (ADA) Hits First Major Breakthrough in Weeks Vitalik Buterin Warns of Hidden Ethereum Attack Risks Paradigm and a16z near $900M in funding deals this year MicroStrategy’s Michael Saylor Proposes Bitcoin-Backed Loans, Why It’s A Bad Idea? NEIRO Price Jumps 215% in A Week, Whale Buys $1.53M Worth; Whats Next? Long-Term On-Chain Metrics Indicate Positive Outlook for Bitcoin Google Cloud and Solana Labs Partner to Launch GameShift for Web3 Gaming Famous Names Who Own Bitcoin (BTC) Have Been Determined! Here's the List Including Elon Musk and CZ! Analyst Identifies the Only 3 Resistance Levels Stopping an XRP Uptrend Core becomes largest Bitcoin sidechain with $423m in TVL ? Firstpost America Reports That Bhutan Has One-Third of Its GDP in Bitcoin Daily Market Review: BTC, ETH, TIA, RON, AR NEAR spikes nearly 31% in 30 days, bulls eye $6 target Expert Says Prepare for XRP Violent Crash as Weak Trendline and Extended Distribution Spell Trouble Analyst Expects XRP Macro Wave 5 to Surpass $3.4 as Fib. 1.618 Support Holds Shiba Inu Sees Explosive 57 Billion Exchange Outflow: What It Means for SHIB Price Document Shows SEC Recognizes Speculation Role in Driving XRP Price and Utility Cardano (ADA) 10% Price Increase Within Reach Bitcoin's Trading Range Extends Beyond 125 Days as September Shows Resilience Great Tech, No Users: How Developer Feedback Can Transform Web3 Projects Bitcoin price target rises to $78K after Chinese stimulus package Aethir Partners With Kima Network to Foster Community Growth Here’s What to Expect as SEC v. Ripple Lawsuit Enters Grand Finale: Expert Cathie Wood's Ark Invest offloads another $2.8 million worth of its own spot Bitcoin ETF Ripple Performs RLUSD Tokens Biggest Mint on XRPL Floki Trading Bot Hits New Milestone with $75M in Trades and 25K+ Active Users HashKey Global Introduces Industry-First Zero-Fee Futures Trading Top Analyst Outlines Mathematical Reasoning Why XRP Hitting $20-30 Isn’t Irrational eToro Launches Spot Crypto Trading in Germany: Partners with Local Firms Solana Price (SOL) Gears Up for Fresh Surge: Is More Upside Ahead? Ondo Finance Brings OUSG and USDY to MakerDAO’s Grand Prix Shiba Inu Consolidation in a Triangle Signals Bullish Breakout to $0.000020 Upbit to store user data on AWS: What users should know Wall Street's Shift: From AI to Bitcoin - A New Frontier Celsius token surges 300% a month after $2.5B payment to creditors Bybit launches the world-first Islamic crypto account Bitget predicts TON ‘de-Telegramization’ in the next 2 years Bitcoin Exchange OKX Shares New Altcoin Listing Announcement! BTC price support at $62K must hold if Bitcoin bears step in — Traders Biggest XRP Bullish Signal Turns Out False: Details PEPE Potential 60% Price Increase Could Be Cut Short By This Signal SEC Under Fire Over Anti-Crypto Policies Crypto.com Announces the Inclusion of $STX for On-Chain Staking Two Surprise Altcoin Listing News Came From South Korea, Prices Jumped! Top FinTech Experts See XRP Hitting $6.45: Here’s When Ripple’s Chris Larsen Unnerves XRP Community with Latest Transfers VeChain News: Tim Draper Endorses Sustainability Through Web3 and VET-Driven Investment Opportunities "Something Big Is Coming" for Shibizens, SHIB Team Says, Sharing Mysterious Message Why Is the Crypto Market Down Today? Speculation Suggests XRP Could Hit $1M if 1 XRP Drop Equals 1 RLUSD Bitcoin (BTC) Price Eyes $64K, NEAR Protocol (NEAR) Soars 20% in 2 Days (Market Watch) Market Analyst Anticipates Ethereum Price Surge to $29,000 Once This Happens XRP News: Ripple’s 1,700 Bank Deals Could Send Prices Soaring – Here’s Why! EigenLayer expects token transfer restrictions to end September 30 Ethereum Rallies to $2,700 as Social Media Buzz and Trading Volume Soar Fed Rate Cut Fuels Bitcoin Price: Can BTC Price Surge Above $65K This Week? Terra Luna Classic Burn Mechanism Revised By Binance, What's Next for LUNC? Is Bitcoin the New Safe Haven as Global Liquidity Falls To Level Not Seen Since 2020 Celestia, Arweave, Jasmy lead as crypto fear and greed rises Sweden sees crypto exchanges as professional money launderers Crypto Exchange Kraken Said to Hire Natasha Powell as UK Head of Compliance Ireland eyes MiCA guardrails to democratize finance with crypto Official OpenAI X Account Hacked in Crypto Scam, Promotes Fake Token Blockchain Space Tokenization: IO’s Novel Approach at AFT 2 Key Signals Driving Toncoin (TON) Traders to Position for a Price Drop Bitcoin ETF Inflows Hit 1,017 BTC as Ethereum ETFs Record $385K Outflow Polkadot Stalls Below $4.5 Even After Agile Coretime Launch: What’s Going On? Drop in Bitcoin dominance and bullish altcoin market structure have traders predicting altseason Bitcoin Little Changed as China Announces Stimulus; Traders Say Harris’ Win Unlikely to be Bearish Flappy Bird will ‘never have’ NFTs but will have a crypto ‘option’ Meme coin Bonk plans to launch an ETP — but is the SEC on board? Top Crypto Investments by Daily Active Users Bitcoin Set for Major Bull Run? These 3 On-Chain Metrics Signal A Turning Point Central Reserve Bank: Only 1.1% of Remittances Involve Cryptocurrency in El Salvador Crypto ETFs continue positive momentum with $321 million net inflows Blockchain Space Tokenization: IO’s Novel Approach at AFT Ripple Moves 200M XRP As Speculations Mount Over US SEC's Lawsuit Appeal Bitcoin on the Edge: Will the 200-Day SMA Breakout Push Prices to $70K Again? Crypto News Today (Sept 24th, 2024): Bitcoin, Ethereum Struggle, While Celestia Gains? US Ethereum ETFs see largest single-day loss since late July as Grayscale Trust sheds $80 million Ethereum outperforms top 20 cryptos as it targets $2,817 XRP Price Defends Support: Will Bulls Take Over? Celsius Token CEL Skyrockets 62%, Signaling Renewed Interest Crypto Funds Extend Positive Streak With $321M Weekly Inflows Ethereum Rebounds to $2,700 as Social Media Buzz and Trading Activity Hit New Highs Best Staking and Investment Cryptocurrencies to Watch Out For in 2024 Bitcoin Options Market Points to Feedback Loop of Higher Prices, Expert Says Bitcoin Price Eases Off Highs: Will Gains Be Cut Further? Rise In announces its 24-hour Neo X Grind hackathon satellite event for Indian developers SUI, SOL, WLD, IMX, ZETA Set for Price Drop as Major Unlocks Approach Binance Security in Question as 13 Million Users’ Data Allegedly Leaked Online Sygnum Secures Liechtenstein License to Expand Crypto Services in EU Coinbase Reveals Support For These 4 Cryptos; Will Prices Rally Ahead? Coinbase Vs. SEC :Commission Failed to Answer in Appeal Court Green United loses bid to dismiss $18M crypto mining fraud suit Candidate Harris Unlikely to Make Full-Throated Crypto Policy Before Election: Source Russian Expert Warns: Hamster Kombat Players Tap for Cash but End Up with Peanuts Ethereum Price Pullback: Another Chance for Buyers To Load ETH? ‘History suggests it’s breakout time for Bitcoin’ — Rekt Capital VP Kamala Harris’s First Speech On Crypto Sparks 7% Rise In This Memecoin AI models will soon serve as personal assistants: Sam Altman $TERMINUS Token Skyrockets 10,000%, Turning $135 into $1.2M in 15 Days SBF’s neurodivergence saw him ‘misinterpreted’ at trial, doctors argue Sui Network Surpasses Avalanche in TVL, Reaches $1 Billion in DeFi Ecosystem Binance and Tokocrypto Collaborate With Indonesia's Law Enforcement to Uncover Major Crypto Fraud, Seize $200K Is Altcoin Season Coming? These Two Signals Could Suggest So Ethereum Rallies to $2,700 Amid Renewed Market Interest: $ETH Price Analysis Mango Markets mulls $500K CFTC settlement amid ‘ongoing’ investigation New Relief for AI Bot Sufferers: Cloudflare’s New Tool Lets Sites Charge For Data Scraping TON Price Jumps 6% Despite Telegram Bowing To Regulatory Pressure Will Caroline Ellison Go to Prison? What You Need to Know Ahead of Sentencing Bitcoin Jumps 22% Post-Fed Rate Cut, Yet Key Resistance Sparks Crash Fears – Bitfinex Core Foundation and Copper.co Launch First Non-Custodial Bitcoin Staking for Institutions US SEC Chair Gary Gensler Confirms Congress Testimony, Here's What To Expect Diamond Hand Ethereum Whale Moves 15,000 ETH, Here’s The Destination House Republicans urge SEC to rescind ‘disastrous’ SAB 121 Solana (SOL) Crashes, But Not as You Think, Shiba Inu's (SHIB) Comeback Potential, Don't Miss This Toncoin (TON) Volatility Pattern Analyst Says Clear Bull Trend Underway for AI-Focused Altcoin, Updates Forecast on FET and Two Other Coins Should You Invest in Litecoin (LTC)? Charts, Stats, Analysis for 2024 Polymarket Reportedly Seeks $50M in Funding, Mulls Token as Election Bets Surge Treasure DAO approves migration to ZKsync, eyes mainnet launch within two months